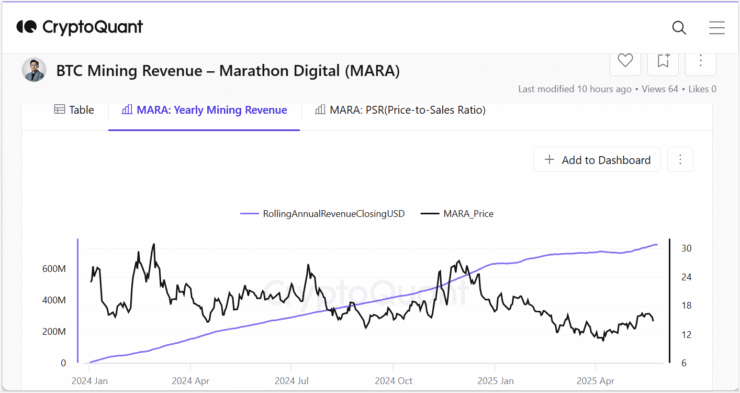

Marathon Holdings, the crypto mining giant formerly known as Marathon Digital, has reached a new all-time high in annualized Bitcoin mining revenue, surpassing $752 million as of May 27. The surge is directly tied to Bitcoin’s recent rally past $112,000—marking the asset’s highest price ever recorded.

The revenue figure was confirmed via on-chain metrics from CryptoQuant. CEO Ki Young Ju noted in a May 27 post that this milestone represented “the most profitable day in the company’s history,” highlighting how real-time blockchain data can capture miner earnings more accurately than traditional quarterly reports.

Marathon remains the largest publicly traded Bitcoin mining firm by market cap, and its record-breaking revenue comes amid broader market trends—such as Japan’s rising bond yields and increased currency volatility—that are believed to be pushing institutional capital toward Bitcoin as a hedge.

The timing of Marathon’s earnings peak—just days after Bitcoin broke through its previous all-time high—underscores the close link between macroeconomic factors and miner profitability. With a strong treasury strategy and expansive on-chain footprint, Marathon appears poised to benefit from the next wave of institutional crypto adoption.

BTC Holdings Pass $5.2B Despite Q1 Miss

Marathon Holdings has surpassed $5.28 billion in Bitcoin holdings, cementing its position as the world’s second-largest corporate BTC holder—just behind Strategy (formerly MicroStrategy). The company currently holds 48,237 BTC, according to on-chain tracking.

The milestone comes despite a 19% drop in Bitcoin production due to the April 2024 halving, which cut mining rewards from 6.25 BTC to 3.125 BTC. The output decline contributed to a slight Q1 earnings miss, with Marathon falling short of Wall Street expectations by 0.35%.

However, the overall price rally in Bitcoin has more than offset reduced production. According to CompaniesMarketCap, Marathon continues to lead the public Bitcoin mining sector with a valuation of $5.18 billion.

Marathon’s decision to adopt Bitcoin as a treasury reserve in July 2024—when it purchased $124 million worth of BTC—has proven lucrative. Its Bitcoin reserves now account for over 0.23% of the total circulating supply, per data from Bitbo.

Miner Revenue Lags Price as Sector Rebuilds

Despite Marathon’s strong numbers, broader mining sector revenue has yet to return to previous highs. Daily miner income across the industry currently averages $50 million—still well below the $80 million peak seen during earlier bull markets.

“There’s still room to climb,” wrote CryptoQuant researcher Axel Adler, noting that miner revenue continues to trail behind Bitcoin’s price surge.

As institutional interest in BTC continues to grow and market conditions remain favorable, analysts expect mining profitability to rise in tandem—potentially setting the stage for a renewed bull cycle in the sector.

Quick Facts

- Marathon’s mining revenue hits record $752M

- Bitcoin price crosses $112K, boosting mining earnings

- Marathon holds 48,237 BTC, worth $5.28B

- Q1 miss due to halving; revenue offset by BTC rally

- Miner sector earnings still below 2021 peak levels