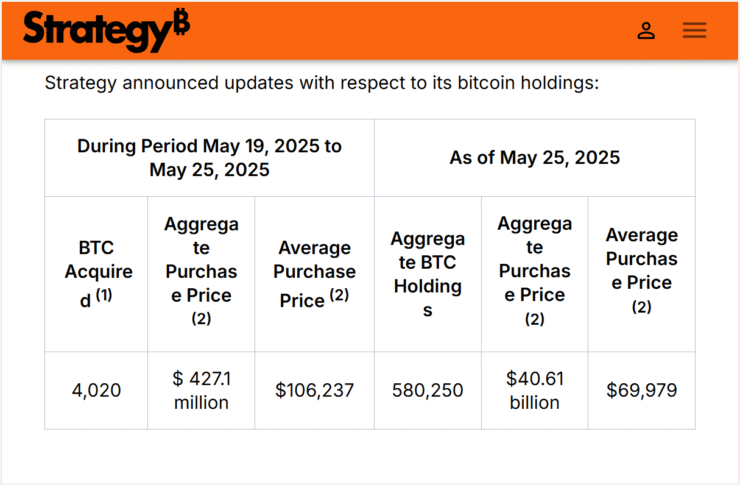

Michael Saylor’s Strategy has deepened its Bitcoin position again, acquiring 4,020 BTC between May 19 and May 23—just as the cryptocurrency soared past its all-time high of $110,000. The acquisition, disclosed on May 26, totaled approximately $427.1 million at an average price of $106,237 per coin.

This latest buy brings Strategy’s total Bitcoin holdings to a staggering 580,250 BTC, purchased for about $40.6 billion at an average entry point of $69,979. It also marks the company’s fourth Bitcoin buy in May alone, reinforcing Saylor’s conviction in BTC as a long-term treasury asset, regardless of market highs.

Bitcoin’s rally past $110,000 on May 22—driven by institutional inflows, macroeconomic optimism, and a regulatory push on stablecoins—has fueled renewed bullish momentum across the crypto market. While some analysts warn of short-term corrections, firms like Strategy appear undeterred, continuing to double down on Bitcoin’s long-term value proposition.

Executives Sell Millions in MSTR Shares

Just days before Strategy announced its $427 million Bitcoin purchase, top executives were trimming their equity positions. A regulatory filing dated May 22 revealed that Strategy director Jarrod Patten sold 2,650 shares of the company’s Class A stock between May 16 and 21, earning nearly $1.1 million.

The filing also shows that Patten has been reducing his position since late April. Since April 22, he has sold 17,050 shares, cashing out approximately $6.7 million in total.

He’s not the only insider taking profits. On May 23, Strategy’s Chief Financial Officer Andrew Kang sold 2,185 Class A shares, earning $719,447, according to an amended disclosure.

The insider selling coincided with heightened market attention on Strategy, as the firm aggressively added Bitcoin and BTC reached new all-time highs. While the sales may raise eyebrows, such moves are often attributed to personal liquidity planning or portfolio diversification—especially given the company’s continued bullish stance.

Strategy Shares Dip as Legal Risks Emerge

Despite its aggressive Bitcoin accumulation, Strategy’s stock has dropped sharply, falling 12% over the past week—from about $420 to $369, according to TradingView data. The decline follows the filing of a class-action lawsuit on May 19, alleging the company misled investors about its Bitcoin-related disclosures.

The suit claims Strategy, led by Executive Chairman Michael Saylor, may have committed securities fraud by overstating the performance or transparency of its Bitcoin holdings, causing financial harm to shareholders during a volatile period in April 2025. Plaintiffs are seeking to recover losses tied to what they allege were material misrepresentations.

The latest 4,020 BTC purchase—valued at $427 million—underscores Saylor’s famous strategy of buying “at the top, forever.” But the timing of the acquisition, combined with insider sales and legal pressure, has raised concerns among some investors about internal sentiment and market confidence.

Quick Facts

- Strategy bought 4,020 BTC for $427.1M at $106K average

- Total BTC holdings now 580,250, worth $40.6B

- Executives sold $6.7M in shares during Bitcoin surge

- MSTR stock fell 12% amid class-action lawsuit

- Lawsuit alleges misleading Bitcoin disclosures to investors