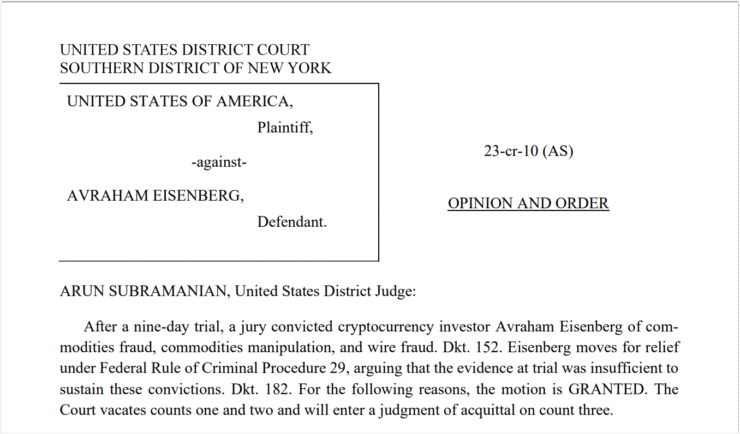

In a surprising twist to one of crypto’s most watched courtroom dramas, U.S. District Judge Arun Subramanian has overturned two fraud convictions against Avraham Eisenberg—the trader behind the $110 million Mango Markets exploit—on the grounds that prosecutors brought the case in the wrong jurisdiction.

Eisenberg had been convicted in April 2024 on charges of commodities fraud, market manipulation, and wire fraud. The case centered on his actions in October 2022, when he manipulated the price of Mango’s native token, MNGO, to inflate his collateral and withdraw substantial funds.

Ruling from the Southern District of New York, Judge Subramanian stated that there was no sufficient connection between Eisenberg’s alleged conduct and the state of New York. “He didn’t make trades in New York, contact anyone in New York, or physically travel there during the execution of his scheme,” the judge wrote. The court also found no credible evidence tying the Mango Markets platform itself to the jurisdiction. Eisenberg conducted his activities from Puerto Rico, and the connections to New York—such as a user in Poughkeepsie and a vendor in Manhattan—were deemed inadequate to establish proper venue.

Prosecutors had argued that Eisenberg’s use of an automated trading platform with operations in New York, along with a single user withdrawal attempt from a New York-based address, should establish venue. But the judge disagreed, emphasizing that such indirect links weren’t enough to try the case in New York, especially given that Eisenberg was operating from Puerto Rico during the exploit.

The ruling vacates Eisenberg’s first two convictions and marks a sharp procedural blow to federal prosecutors, who had touted the case as a landmark fraud prosecution in decentralized finance.

Wire Fraud Charge Also Dismissed on Legal Grounds

In addition to vacating two fraud convictions for lack of jurisdiction, Judge Arun Subramanian also dismissed a third charge—wire fraud—against Avraham Eisenberg, citing both legal insufficiency and improper venue. The decision represents a major turning point in the legal treatment of exploitative behavior on decentralized finance (DeFi) platforms.

Eisenberg was accused of manipulating a price oracle to artificially inflate the value of his collateral before withdrawing millions from Mango Markets. While prosecutors framed it as deception, Eisenberg’s defense insisted it was simply a calculated trading move on a platform without established rules. Judge Subramanian appeared to agree, writing:

“On a platform with no rules, instructions, or prohibitions about borrowing, the government needed more to show that Eisenberg made an implicit misrepresentation by allowing the algorithm to measure the actual value of his collateral,” Judge Subramanian wrote.

While the Justice Department may still pursue a new case in a proper venue, Eisenberg’s attorney, Brian Klein, celebrated the ruling as a validation of their core argument.

“From the beginning, we said this case was fatally flawed,” Klein told Bloomberg.

Eisenberg still faces a four-year sentence for unrelated charges involving child sexual abuse material, a case that remains unaffected by the recent ruling.

Quick Facts

- Avraham Eisenberg’s convictions in the Mango Markets case were overturned due to improper venue and insufficient evidence of misrepresentation.

- The court highlighted the difficulty of applying traditional fraud laws to decentralized platforms like Mango Markets.

- The ruling could shape future regulatory approaches to DeFi and underscores the need for updated legal frameworks.

- Eisenberg still faces civil actions from the SEC and CFTC and is serving a separate sentence for unrelated charges.