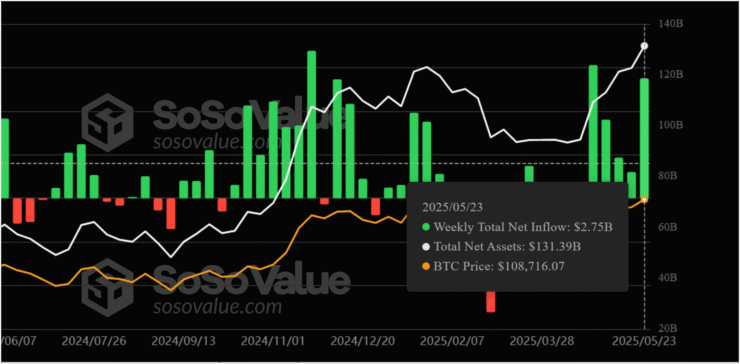

U.S.-listed spot Bitcoin ETFs have just wrapped their most active trading week of 2025, with a staggering $25 billion in weekly volume, according to SoSoValue data. This marks the highest activity level since the December 2024 rally, driven by Bitcoin’s push toward new all-time highs and a surge in demand for regulated crypto exposure. Weekly net inflows totaled $2.75 billion—the second-highest on record since spot ETFs launched in early 2024.

The sharp rebound in volume reflects renewed confidence in the crypto sector. With Bitcoin trading just below its peak, both institutional and retail investors are increasingly turning to ETFs as a familiar vehicle for digital asset allocation. For many, ETFs offer a secure, regulated way to participate in crypto without the complexities of custody and direct token management.

BlackRock’s IBIT Stands Alone

At the center of this resurgence is BlackRock’s iShares Bitcoin Trust (IBIT), which has now maintained 30 consecutive trading days without any meaningful outflows. The ETF has seen consistent inflows nearly every day over the past month, growing its assets under management to more than $71 billion. That figure now represents roughly 3.3% of Bitcoin’s entire circulating supply.

IBIT’s dominance underscores investor preference for established asset managers during times of market volatility. Its lead over Fidelity’s Wise Origin Bitcoin Fund (FBTC)—which manages less than one-third of IBIT’s total—is further evidence that scale, brand reputation, and perceived stability are shaping investor behavior in this fast-evolving segment.

Ethereum Investment Products Attract Renewed Interest

While Bitcoin funds have captured most of the attention, Ethereum-linked ETFs also had a notable week. ETH funds pulled in nearly $250 million in inflows—their best weekly performance since early February. This suggests that investors are beginning to rotate some capital back into Ethereum, seeing opportunity beyond the Bitcoin narrative.

Despite the inflows, overall trading volume for Ethereum ETFs dipped slightly, suggesting that capital is flowing in, but short-term trading activity remains primarily concentrated around Bitcoin’s momentum.

ETF Growth Signals Broader Market Confidence

The record-breaking ETF volume mirrors growing institutional conviction in crypto as a maturing asset class. Spot Bitcoin ETFs, in particular, are playing a critical role in bridging the gap between traditional finance and decentralized technology, offering a compliant gateway for exposure without the friction of crypto-native platforms.

This continued flow of capital into ETFs also indicates that demand isn’t solely speculative. As investors view Bitcoin increasingly as a hedge against inflation and macroeconomic instability, ETFs are providing the infrastructure needed to scale that narrative to Wall Street.

Analysts say that if this level of ETF activity persists, it could offer a floor of demand that helps stabilize Bitcoin’s price amid broader market fluctuations. With IBIT absorbing more of Bitcoin’s circulating supply, its influence on price dynamics and investor psychology is growing. As macroeconomic uncertainty lingers and regulatory frameworks evolve, ETF inflows are likely to remain a major force shaping the crypto landscape in 2025.

Quick Facts

- Bitcoin ETFs recorded a record $25 billion in weekly volume.

- Net inflows hit $2.75 billion—the second-highest since launch.

- BlackRock’s IBIT has held 30 consecutive days without outflows.

- Ethereum ETFs attracted $250 million in inflows—the most since February.

- Analysts see ETF demand as a key support for Bitcoin’s price trajectory.