Strive Enterprises, the asset manager co-founded by former U.S. presidential candidate Vivek Ramaswamy, is preparing a bold move into Bitcoin by targeting distressed claims tied to the infamous Mt. Gox collapse. The firm revealed in a new SEC filing that it plans to acquire as much as 75,000 BTC—currently worth over $8 billion—as part of a broader strategy to build a Bitcoin-focused treasury.

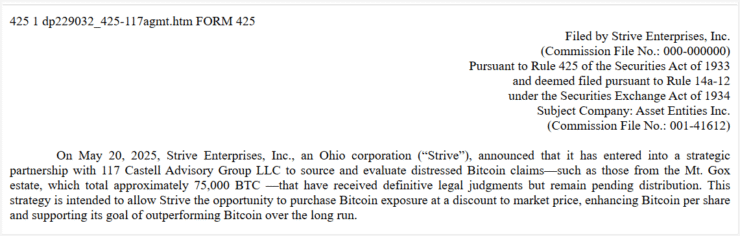

In Tuesday’s disclosure, Strive announced a partnership with 117 Castell Advisory Group to identify legally valid but discounted Bitcoin claims, with a particular focus on the Mt. Gox estate. Once the world’s largest crypto exchange, Mt. Gox collapsed in 2014 and is now finalizing creditor repayments, scheduled for completion by October 31, 2025.

The 75,000 BTC associated with the estate represent one of the most significant Bitcoin reserves still locked in legal proceedings. Strive’s goal is to purchase these claims before the repayments are distributed, giving the firm exposure to Bitcoin at below-market rates. The strategy could significantly improve the company’s BTC-per-share ratio as it prepares to go public.

“This strategy is intended to allow Strive the opportunity to purchase Bitcoin exposure at a discount to market price,” the firm stated in its SEC filing.

Strive Preps for Public Listing via Reverse Merger

The move is part of Strive’s lead-up to a reverse merger with Nasdaq-listed Asset Entities, which would take the company public and align it with other Bitcoin-treasury firms. Strive aims to become one of the first publicly traded asset managers with a Bitcoin-centric financial strategy.

The merger, first announced earlier this month, will be formalized through a proxy statement and prospectus distributed to shareholders in the coming weeks. If completed, the combined company would join the ranks of Bitcoin-heavyweights like Strategy (formerly MicroStrategy) and Japan’s Metaplanet.

On Monday, Strategy announced it had acquired another 7,390 BTC for $764.9 million, bringing its total to 576,230 BTC. Metaplanet followed with a 1,004 BTC purchase, raising its holdings to 7,800 BTC.

Strive’s model, however, differs from direct acquisition. By targeting distressed claims like those in the Mt. Gox estate, it hopes to outperform Bitcoin itself by building a reserve at a lower cost basis.

Nasdaq Listing Key to Bitcoin Treasury Expansion

The merger with Asset Entities gives Strive access to public capital markets, allowing it to scale its Bitcoin acquisition strategy with greater efficiency. Through its Nasdaq listing, Strive intends to raise funds and aggressively pursue distressed crypto opportunities.

The firm sees its approach as a new model for corporate Bitcoin adoption—emphasizing arbitrage, value creation, and treasury innovation. Its upcoming proxy statement will provide further details as it seeks shareholder approval and regulatory clearance to complete the merger.

If successful, Strive will emerge as a serious contender in the evolving class of Bitcoin-first public companies.

Quick Facts

- Strive plans to acquire up to 75,000 BTC via distressed Mt. Gox claims, valued at over $8 billion.

- The firm is preparing for a reverse merger with Nasdaq-listed Asset Entities to become a public company.

- Strategy and Metaplanet recently expanded their Bitcoin reserves to 576,230 and 7,800 BTC, respectively.

- Strive aims to outperform Bitcoin by acquiring discounted assets through legal arbitrage opportunities.