The U.S. Securities and Exchange Commission (SEC) has filed charges against crypto startup Unicoin Inc. and several of its executives, accusing them of misleading thousands of investors in a $110 million token sale disguised as a secure, asset-backed investment.

Filed in the Southern District of New York, the complaint alleges that Unicoin’s leadership falsely claimed its tokens would be backed by a global portfolio of real estate and equity holdings. The SEC contends that these claims were knowingly exaggerated and used to market “rights certificates” tied to the Unicoin token.

Named in the complaint are CEO Alex Konanykhin, board member Silvina Moschini, and former Chief Investment Officer Alex Dominguez. Unicoin’s general counsel, Richard Devlin, was also cited for his role in preparing misleading legal offering documents. Though he did not admit guilt, Devlin has agreed to pay a $37,500 fine and accept a permanent injunction barring future violations.

“Unicoin and its executives exploited thousands of investors with fictitious promises that its tokens… would be backed by real-world assets,” said Mark Cave, associate director of the SEC’s Division of Enforcement.

“But as we allege, the real estate assets were worth a mere fraction of what the company claimed.”

The SEC is seeking additional penalties, including officer bans and court injunctions, as part of a broader crackdown on crypto investment fraud.

SEC Says Unicoin Misled Investors With Fake Claims

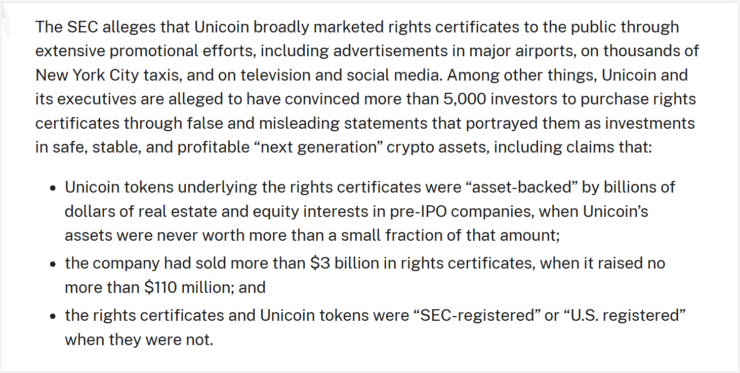

The SEC’s complaint alleges that Unicoin executives falsely advertised their offering as SEC-registered and significantly overstated how much they raised. Marketing materials claimed the firm had secured $3 billion in investments, while actual totals were just over $110 million.

According to the filing, CEO Alex Konanykhin personally sold nearly 38 million “rights certificates” to retail investors who typically would not qualify under U.S. securities laws. The tokens were promoted through a widespread marketing blitz that included television ads, airport banners, and digital screens in taxis.

The SEC argues that these materials framed Unicoin as a highly secure, institutional-grade crypto opportunity—claims the agency now says were wildly misleading.

Enforcement Case Comes Amid Broader SEC Strategy Shift

The case against Unicoin stands out as one of the few major enforcement actions proceeding under the SEC’s current leadership, as Chair Paul Atkins has taken steps to reduce or dismiss several high-profile crypto lawsuits inherited from the Gensler era.

While enforcement efforts against Coinbase, Ripple, Kraken, and Consensys have been scaled back or paused, the SEC is moving forward with its case against Unicoin—suggesting the agency sees it as a clear example of material investor harm.

Unicoin CEO Alex Konanykhin has publicly denied the SEC’s allegations and vowed to contest the lawsuit, calling the charges politically motivated and outdated.

In comments to reporters, Konanykhin described the case as “grotesque,” claiming that Unicoin is “the most compliant crypto company in the U.S.” He also alleged that the charges are being pushed by “rogue officials” from the previous SEC administration, attempting to pressure the company into a false settlement.

“They’re trying to bully us into a false admission of guilt,” Konanykhin said, asserting that current SEC leadership under Paul Atkins is not aligned with the enforcement tactics used in the lawsuit.

Quick Facts

- The SEC has charged Unicoin and its executives for misleading investors in a $110 million token sale.

- CEO Alex Konanykhin, board member Silvina Moschini, and two other executives are named in the complaint.

- The SEC alleges Unicoin falsely claimed its tokens were SEC-registered and backed by real-world assets.

- Unicoin denies the charges and says the case is politically motivated and legally flawed.