Bitcoin exchange-traded funds (ETFs) recorded their strongest single-day inflows since early May, with Fidelity and ARK Invest leading the pack. As institutional interest returns amid Bitcoin’s sustained rally, the two funds attracted a combined $343 million—more than half of Monday’s total inflows across all U.S. spot Bitcoin ETFs.

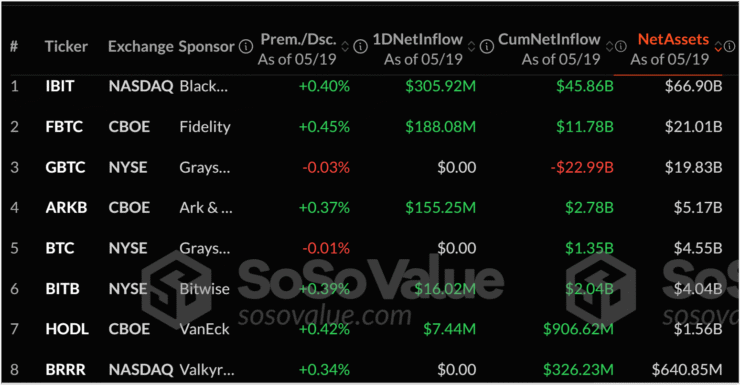

Fidelity’s Wise Origin Bitcoin Fund (FBTC), the second-largest spot Bitcoin ETF in the U.S., brought in $188 million in net inflows in just 24 hours, according to data from SoSoValue. Close behind, the ARK 21Shares Bitcoin ETF (ARKB) saw $155 million in inflows, maintaining its position as the fourth-largest fund, behind the Grayscale Bitcoin Trust.

The surge in ETF flows reflects growing institutional confidence in Bitcoin, which has displayed impressive price stability. As of Monday, total inflows into all spot Bitcoin ETFs reached $667.4 million. Bitcoin has now traded above $100,000 for 12 consecutive days and recently posted its highest weekly close in history. At press time, BTC was priced at $105,137, up 2.1% on the day.

This wave of capital suggests renewed appetite for crypto-backed financial instruments, with Fidelity and ARK rapidly gaining momentum as investor sentiment continues to improve.

BlackRock’s IBIT Dominates Inflows, Surpassing Gold ETF Demand

BlackRock’s iShares Bitcoin Trust (IBIT) remained the dominant force in the Bitcoin ETF space, pulling in $305.9 million in inflows on Monday—nearly half of the day’s $667 million total. With $66.9 billion in net assets, IBIT now accounts for roughly 3.2% of Bitcoin’s total market cap.

The fund has clearly outpaced Wall Street rivals, becoming the largest and most active Bitcoin ETF on the market. According to Bloomberg ETF analyst Eric Balchunas, IBIT’s year-to-date inflows have reached $8.3 billion, making it the sixth most popular ETF in the U.S. by 2025 inflows. In comparison, the SPDR Gold Trust—despite gold’s outperformance this year—ranks 17th.

Fueling some of IBIT’s momentum is a surge in institutional arbitrage activity. Hedge funds have been actively exploiting the “basis trade,” a strategy that capitalizes on the price gap between Bitcoin’s spot and futures markets, offering attractive yield opportunities and drawing more capital into the ETF ecosystem.

Bitcoin Lags Gold in 2025 Surge Despite ETF Inflows

While Bitcoin ETFs continue to attract substantial inflows, Bitcoin itself still trails gold in year-to-date gains. As of now, BTC is up about 12% in 2025, while gold has climbed more than 22%, buoyed by rising geopolitical tensions and market uncertainty driven by President Donald Trump’s tariff-driven economic policies.

Despite this, Bitcoin’s performance and rising inflows have re-ignited attention across traditional financial circles—though not everyone is on board.

A notable holdout in the Bitcoin ETF space remains Vanguard, the $8 trillion asset management behemoth. The firm has long dismissed cryptocurrencies as speculative and unsuitable for long-term portfolios, and it continues to block access to Bitcoin ETFs through its brokerage platform.

However, Bloomberg’s Eric Balchunas believes Vanguard’s stance may eventually shift. If Bitcoin’s price reaches the $150,000 to $200,000 range, rising investor pressure could force a policy rethink. The firm’s newly appointed CEO reportedly has past ties to BlackRock’s ETF division, including its involvement with IBIT, further fueling speculation that a pivot could eventually occur.

Quick Facts

- Fidelity and ARK Invest pulled in a combined $343 million in Bitcoin ETF inflows, the highest daily total since early May.

- BlackRock’s IBIT added $306 million on the same day, raising its net assets to $66.9 billion and accounting for over 3% of Bitcoin’s market cap.

- Bitcoin is up 12% in 2025, but still trails gold, which has gained 22% amid global macro uncertainty.

- Vanguard remains absent from the Bitcoin ETF space, though analysts suggest its position could shift if Bitcoin prices continue climbing.