Investor appetite for Ethereum spiked last week, as crypto funds posted one of their strongest performances of 2025—driven by rising institutional confidence in Ethereum’s ongoing technical evolution. According to CoinShares, Ethereum investment products recorded $205 million in inflows, a massive leap from just $1.5 million the week before.

The surge follows Ethereum’s recent rally toward $2,700 and growing anticipation around the Pectra upgrade, which introduced improvements to validator staking and smart contract functionality. Although the asset briefly corrected to $2,400 early in the week, Ethereum remains up nearly 50% for the month—significantly outperforming most altcoins.

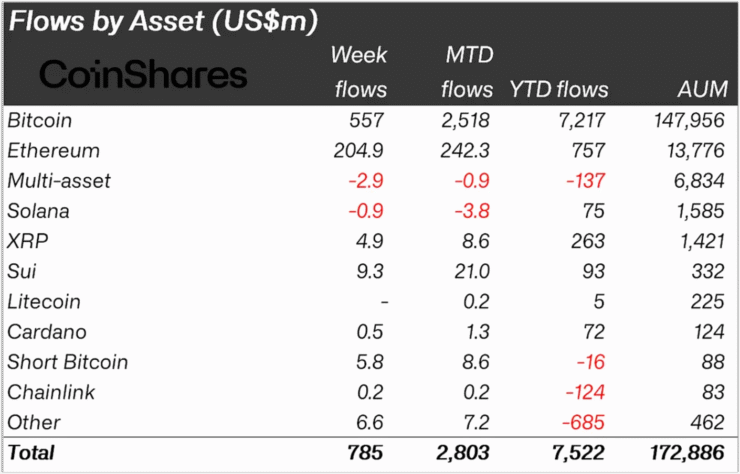

Overall, digital asset investment products saw $785 million in inflows last week, pushing year-to-date figures above $7.4 billion—the highest level so far in 2025. Bitcoin led the charge with $557 million in inflows, but Ethereum stood out as the clear institutional highlight.

“Ethereum was the standout performer,” said CoinShares Head of Research James Butterfill, while noting that Solana-based funds, by contrast, saw $1 million in net outflows.

Pectra Upgrade Fuels Network Efficiency and Confidence

Ethereum’s recent Pectra upgrade is already reshaping investor sentiment, with meaningful enhancements to scalability and validator capacity helping solidify long-term confidence in the network. Activated less than two weeks ago, Pectra’s first phase aims to reduce transaction fees while raising the maximum stake per validator—both critical to improving decentralization and throughput.

These upgrades have likely contributed to Ethereum’s inflow spike last week. The $205 million in institutional fund allocations marks one of the asset’s best weeks this year, highlighting growing enthusiasm among long-term investors.

Still, Bitcoin remained dominant. CoinShares data shows that BTC products attracted $557 million in inflows last week, bringing Bitcoin’s total year-to-date inflows to $7.2 billion—by far the largest among all digital assets in 2025 so far.

Ethereum ETFs Lag Behind Bitcoin as Staking Debate Grows

Digital asset investment products have now seen five consecutive weeks of inflows, with the latest week pushing total 2025 flows to $7.5 billion—surpassing the previous peak of $7.2 billion set in February before geopolitical headlines briefly roiled markets.

Despite Ethereum’s recent gains, spot Ethereum ETFs in the U.S. continue to underperform relative to Bitcoin’s. According to Coinglass, Ethereum ETFs have pulled in just $2.5 billion since launching in 2024, far behind the $42 billion taken in by Bitcoin ETFs over the same period.

Analysts point to one critical factor: staking. Ethereum’s proof-of-stake model allows ETH holders to earn rewards by validating transactions, but ETF investors currently lack access to those staking yields. Without this revenue stream, Ethereum ETFs are perceived as less attractive compared to holding the asset directly or owning Bitcoin, which doesn’t rely on staking for returns.

As institutional interest in staking grows, the absence of staking exposure in ETFs may be limiting Ethereum’s potential in traditional markets—even as it gains momentum in the crypto-native ecosystem.

Quick Facts

- Ethereum investment products saw $205 million in inflows last week, up sharply from just $1.5 million the week prior.

- The recent Pectra upgrade improved Ethereum’s scalability and validator staking limits, boosting institutional confidence.

- Bitcoin led overall fund flows with $557 million in inflows, bringing its 2025 total to $7.2 billion.

- Ethereum ETFs continue to lag behind Bitcoin ETFs due to the absence of staking rewards for fund holders.