Robert Kiyosaki, the outspoken author of Rich Dad Poor Dad, is doubling down on his decades-long criticism of fiat currency, calling on Americans to ditch the dollar in favor of decentralized alternatives like Bitcoin, gold, and silver. In a pointed post on May 10, Kiyosaki accused central banks—particularly the U.S. Federal Reserve—of manipulating economic systems to the detriment of individual wealth.

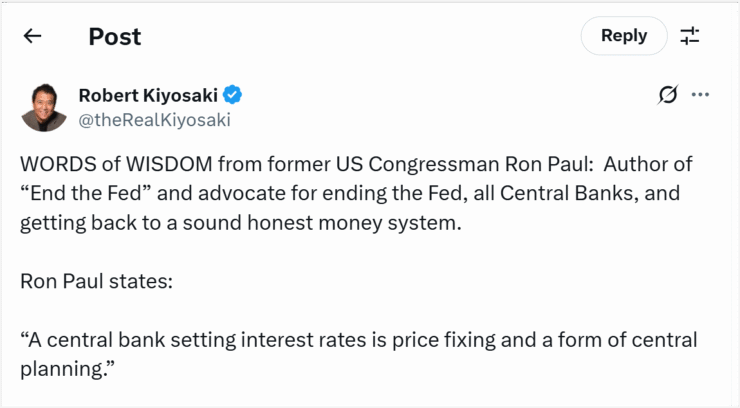

Quoting former Congressman Ron Paul, Kiyosaki echoed concerns that central bank-driven interest rate policies are tantamount to “price fixing,” which he likened to economic strategies seen in Marxist regimes.

“Fake money leads to fake accounting, fake leadership, and everyday corruption,” Kiyosaki warned, adding that such systems erode financial integrity and personal freedom.

His message to the public was clear: exit fiat systems and invest in resilient assets. Bitcoin, which he has previously projected could reach $1 million by 2035, sits alongside gold and silver in Kiyosaki’s preferred arsenal of wealth protection tools.

While Kiyosaki’s anti-establishment message isn’t new, it arrives at a time when mainstream confidence in fiat stability is once again under scrutiny—giving his decentralized investment thesis renewed relevance.

Kiyosaki Doubles Down on Bitcoin as Dollar Weakens

Robert Kiyosaki isn’t backing off his critique of fiat money—he’s intensifying it. The Rich Dad Poor Dad author continues to sound the alarm over what he describes as the slow death of the U.S. dollar, driven by inflation, unsustainable debt, and unchecked central bank policy. Citing his long-standing belief in Austrian economics and personal financial sovereignty, Kiyosaki argues that fiat currency is inherently flawed and destined to fail.

Instead, he urges the public to adopt what he calls a “decentralized standard,” anchored in Bitcoin, gold, and silver. These assets, he says, are resistant to political manipulation and central bank interference, making them ideal for long-term wealth preservation.

“Don’t work or save fake money,” he warned.

“Build wealth on hard assets.”

Kiyosaki has remained particularly bullish on Bitcoin, forecasting a price of $1 million by 2035. He also expects gold to climb to $30,000 per ounce and silver to reach $3,000, predicting that inflation will continue to erode fiat purchasing power. His forecasts echo similar sentiments from ARK Invest CEO Cathie Wood, who projected that Bitcoin could top $1.5 million by 2030, and Eric Trump, who echoed similar bullish views during his keynote at the Bitcoin MENA conference in Abu Dhabi.

As financial uncertainty looms globally, Kiyosaki’s message is unambiguous: the era of “fake money” is ending, and the future belongs to decentralized, finite, and sovereign assets.

Quick Facts

- Robert Kiyosaki urges Americans to abandon fiat currency and invest in Bitcoin, gold, and silver.

- He predicts Bitcoin could hit $1 million by 2035, alongside gold at $30,000 and silver at $3,000.

- Kiyosaki criticizes the U.S. Federal Reserve and central banks for manipulating markets through rate-setting and monetary expansion.

- His message aligns with growing investor interest in decentralized assets as inflation and geopolitical risks threaten fiat stability.