Bitcoin could be heading for a major breakout in 2025, according to Arthur Hayes, former BitMEX CEO and current CIO of Maelstrom. Speaking at the Token2049 conference in Dubai, Hayes argued that macroeconomic conditions—particularly U.S. monetary policy—have created the ideal backdrop for another surge in risk assets, with Bitcoin leading the charge.

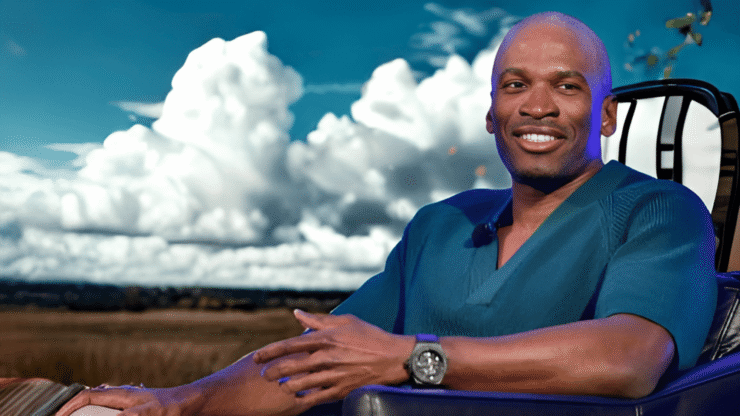

In a recent interview with Crypto Banter, Hayes forecasted that Bitcoin could hit $150,000 before year-end, driven largely by expectations of persistent inflation and the Federal Reserve’s reluctance to raise interest rates further. He likened the current environment to the risk-on rally that occurred between mid-2022 and early 2025, attributing the anticipated move to what he sees as inevitable liquidity injections by central banks.

“I think that the setup is perfect for a rally on risk assets, just like we saw in the third quarter of 2022 until early 2025,” Hayes said.

While he sees Bitcoin leading the charge, Hayes also noted that a broader altcoin rally would likely follow once BTC reclaims dominance—setting the stage for a full-blown crypto bull cycle.

Fed Pause, ETF Flows, and Inflation Fears Fuel Bitcoin’s Climb

Bitcoin’s steady rise to over $99,000 this week is being fueled by a familiar combination of macroeconomic forces: a dovish Federal Reserve, growing inflation concerns, and a wave of institutional capital entering the crypto space. The Fed’s decision to keep interest rates steady on Wednesday triggered a modest uptick across crypto markets, reinforcing a long-standing thesis among Bitcoin proponents—that looser monetary policy and fiat debasement boost the appeal of digital assets.

Historically, Bitcoin has rallied during periods of low interest rates and aggressive money printing, as investors increasingly view it as a hedge against central bank overreach. That sentiment appears to be resurfacing in 2025, particularly as inflation persists and political uncertainty clouds fiscal outlooks. Crypto bulls argue this is precisely the kind of environment that draws renewed capital into the space.

Much of that capital is now flowing through newly approved spot Bitcoin exchange-traded funds (ETFs), which have opened the door for mainstream investors to gain BTC exposure through traditional brokerage accounts. Since launch, these regulated products have attracted billions in inflows, serving as a key on-ramp for both retail and institutional investors.

Hayes—who was pardoned earlier this year by crypto-friendly President Trump—believes the rally won’t stop at Bitcoin. He predicts Ethereum and Solana will follow BTC’s trajectory later this year, buoyed by the same macro tailwinds. Still, he tempered expectations with a dose of humor, noting that while his macro calls often prove accurate, his short-term predictions haven’t always landed.

Quick Facts

- Arthur Hayes predicts Bitcoin could reach $150,000 by year-end, citing inflation and a dovish Fed as core drivers.

- He believes the current macro environment mirrors past “risk-on” cycles, where liquidity injections drove asset rallies.

- Hayes expects Ethereum and Solana to follow BTC’s lead later in 2025 as the altcoin market regains momentum.

- Despite optimism, Hayes admits his short-term market timing has been hit-or-miss, urging investors to stay cautiously bullish.