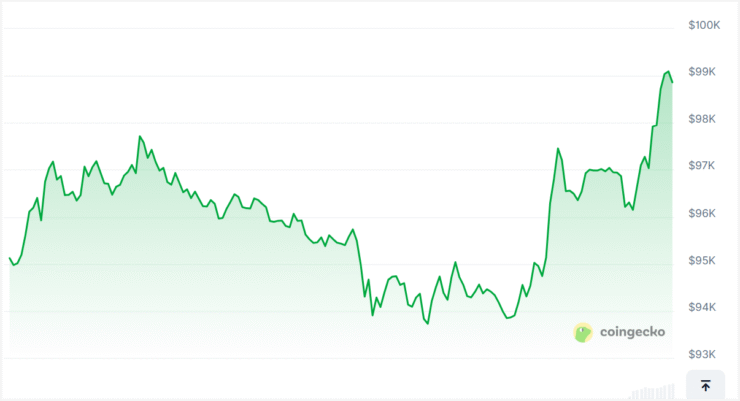

Bitcoin briefly surged past $99,000 early Thursday, flirting with record territory as investors reacted to a potential trade breakthrough between the U.S. and the United Kingdom. The rally—pushing BTC up more than 2.5% before a modest pullback—marked the cryptocurrency’s highest level since February and brought the symbolic $100,000 milestone within striking distance.

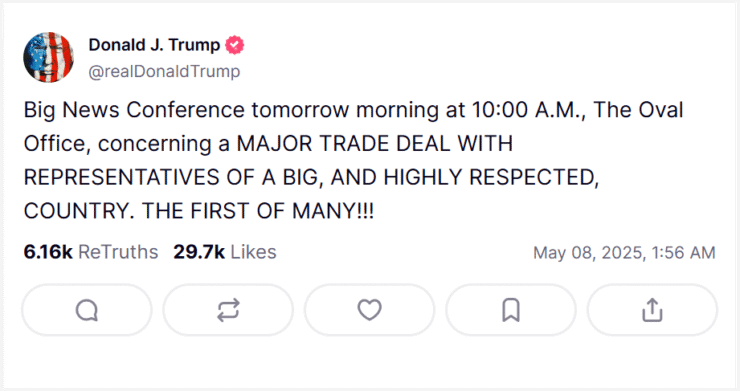

The immediate catalyst was a cryptic post by President Donald Trump on Truth Social late Wednesday, hinting at a “MAJOR TRADE DEAL” with a “big, and highly respected, country.” While he offered no details, sources cited by The New York Times later confirmed the deal involves the UK—a development that could signal a softening of Trump’s aggressive trade posture and bring relief to markets rattled by escalating tariff tensions.

Bitcoin’s upward momentum appears to reflect more than just bullish technicals. Investor sentiment is turning on hopes that a de-escalation in trade disputes could unlock broader economic optimism. If finalized, the agreement could temper fallout from Trump’s “Liberation Day” trade policy, which has strained supply chains and weighed on both equities and digital assets in recent weeks.

Rally Gains Fuel from Trade Optimism and Fed Stability

At the core of the negotiations is Britain’s long-standing push to reduce U.S. tariffs, including a 10% baseline levy and additional 25% duties on exports such as steel, aluminum, and vehicles. According to early reports, the pending deal could offer relief on these fronts.

In return, the UK is expected to ease or repeal its digital services tax—widely viewed as targeting U.S. tech giants—and relax tariffs on agricultural imports, creating potential new markets for American producers. If formalized, the deal would mark a turning point in U.S.-UK economic relations and could send positive ripples across commodities, equities, and the digital asset space.

Bitcoin also benefited from a measured statement by the Federal Reserve on Wednesday. The Fed left interest rates unchanged at 4.25%–4.50%, reaffirming its cautious stance while acknowledging resilience in the broader U.S. economy. Fed Chair Jerome Powell pointed to continued macro uncertainty but emphasized that the economic foundation remains solid.

The combination of softening trade tensions and a steady Fed stance appears to have reignited risk appetite, with equity indices posting modest gains and crypto investors doubling down on Bitcoin’s long-term narrative.

Analysts Warn of ‘Trump Put’ as Sentiment Runs High

Market enthusiasm around Bitcoin’s rally may be driven more by political signaling than by fundamentals, according to Aurelie Barthere, principal analyst at Nansen. Speaking to reporters, Barthere suggested that recent statements from President Trump and Treasury Secretary Scott Bessent have fueled expectations that the administration won’t let markets fall too far.

This sentiment is contributing to what analysts are calling a “Trump put”—a belief that the White House will intervene to stabilize risk assets, from equities to digital currencies, should they begin to slide.

“There’s a growing sense that the White House will step in if markets slide too far,” Barthere said. She noted that while this perception has strengthened investor confidence, it may also inflate expectations beyond what current conditions justify.

Barthere warned that while Nansen models give Bitcoin a 55% chance of reaching new all-time highs, the bullish setup is now “less asymmetric”—suggesting gains may be harder to come by and increasingly sensitive to trade headlines, especially those involving China.

Quick Facts

- Bitcoin surged past $99,000, its highest price since February, nearing its all-time high.

- President Trump hinted at a major trade deal with the UK, fueling optimism that tariff tensions may ease.

- Markets welcomed the news, seeing it as a potential softening of Trump’s aggressive trade stance.

- The rally reflects renewed macro confidence, combining political momentum with technical strength.