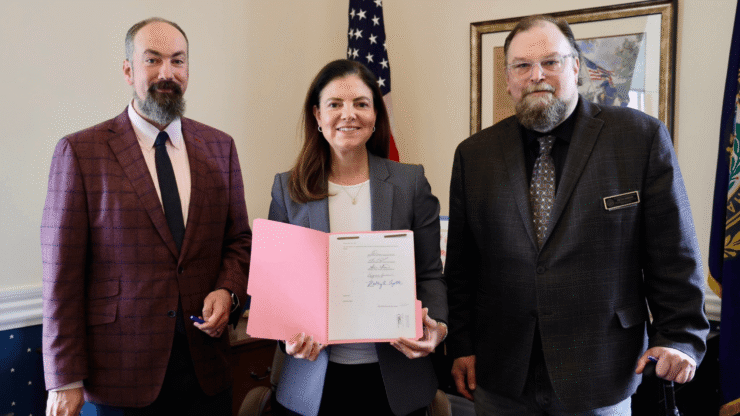

New Hampshire has officially become the first U.S. state to authorize the creation of a Bitcoin reserve, following the signing of House Bill 302 by Governor Kelly Ayotte on Tuesday. The legislation places the Granite State at the forefront of crypto adoption in public finance—a development that could influence how other states approach digital asset integration.

“New Hampshire is once again first in the nation!” Ayotte wrote on X,

“Just signed a new law allowing our state to invest in cryptocurrency and precious metals.”

Originally introduced in January, HB 302 permits the state treasurer to allocate up to 5% of New Hampshire’s public funds into alternative stores of value—including precious metals like gold and silver, as well as digital assets that have maintained an average market capitalization of at least $500 billion over the past year. Under that threshold, Bitcoin currently stands as the only qualifying cryptocurrency.

The bill’s passage highlights not only New Hampshire’s proactive stance on crypto policy but also reflects a growing trend among U.S. states seeking inflation-resistant financial strategies amid shifting macroeconomic conditions.

“If the federal government managed the dollar better, we wouldn’t need to be considering these things,” said Representative Keith Ammon, the bill’s sponsor.

“But inflation is eating our lunch. And this is one little way our state could hedge against inflation in the future.”

New Hampshire Could Allocate $181M to Bitcoin Under New Law

With over $3.62 billion in state-managed funds as of year-end 2024, New Hampshire can now invest up to $181 million into Bitcoin under its new reserve law. At current prices, that allocation would equate to approximately 1,194 BTC—potentially giving the state a notable position in the global digital asset market.

The legislation grants the state treasurer broad discretion over how these holdings are managed. Bitcoin can be stored through secure direct custody arrangements, managed via third-party custodians, or accessed through U.S.-regulated exchange-traded products. This structure ensures both institutional-grade security and compliance, positioning New Hampshire to responsibly manage its crypto exposure while keeping public funds safe.

More importantly, the law sends a clear message: Bitcoin is no longer just a speculative tool—it’s being treated as a legitimate treasury asset.

New Hampshire Leads as Other States Falter in Bitcoin Reserve Push

New Hampshire may be first to enact a Bitcoin reserve policy, but it’s not the only state exploring this path. Arizona’s legislature passed a similar proposal earlier this year, only for it to be vetoed by Governor Katie Hobbs last week, citing concerns over volatility and risk exposure.

Elsewhere, states like Florida, Pennsylvania, and Montana have introduced reserve-related bills, but most have either stalled or been withdrawn amid political and fiscal uncertainty.

New Hampshire’s move also comes as federal interest in Bitcoin intensifies. In March, President Donald Trump signed an executive order establishing a strategic Bitcoin reserve and a broader digital asset stockpile at the federal level—framing digital currency as a strategic financial hedge and economic innovation tool.

As of publication, Bitcoin is trading just above $97,000, up slightly over the past 24 hours. While still about 12% below its January all-time high of $108,786, institutional and governmental demand continues to support bullish market sentiment.

Quick Facts

- New Hampshire is the first U.S. state to authorize public fund investment into Bitcoin.

- The new law permits up to 5% of state reserves to be allocated to Bitcoin and precious metals.

- Bitcoin is the only eligible crypto asset under the bill’s market cap criteria.

- The move could set a precedent for other states considering crypto-backed treasury diversification.