Bitcoin ETFs have extended their bullish streak with another week of impressive inflows, pulling in over $1.8 billion between April 28 and May 4, according to data from CoinGlass. The momentum underscores a growing investor preference for Bitcoin over traditional safe havens like gold.

Thursday and Friday were particularly strong, with inflows of $423 million and $675 million, respectively. Friday’s figure marked the seventh-highest single-day ETF inflow of 2025.

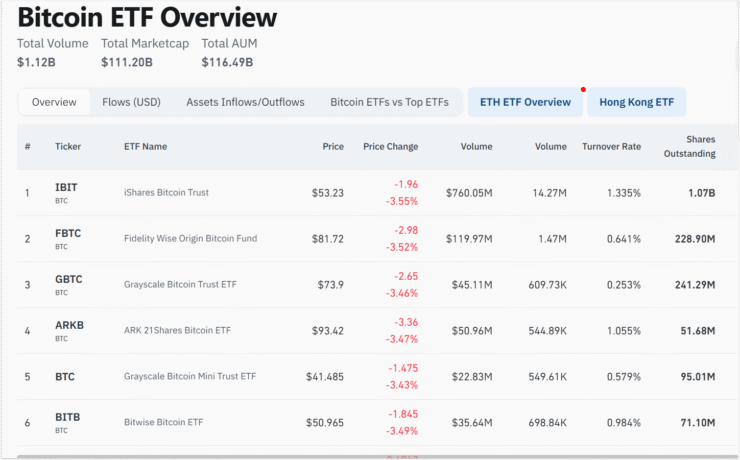

CoinShares’ latest Digital Asset Fund Flows report confirms the trend, showing BlackRock’s iShares Bitcoin Trust (IBIT) leading the market with $2.56 billion in net inflows. In contrast, competitors like Ark 21Shares experienced substantial redemptions—Ark alone saw $458 million in outflows—signaling a consolidation of investor confidence around a select few ETF providers.

While Bitcoin ETFs have surged, gold ETFs have faced sustained outflows. Between April 28 and May 2, gold funds recorded redemptions totaling $1.94 billion. For the second week in a row, the divergence between Bitcoin and gold ETF flows neared the $4 billion mark, suggesting a broader reallocation of capital in response to macroeconomic pressures and evolving risk preferences.

The numbers reflect a wider narrative: in the face of geopolitical instability and uncertain U.S. fiscal policy, institutional capital continues to gravitate toward Bitcoin as a modern hedge against systemic risk.

Institutional Capital Driving Bitcoin ETF Boom

According to BlackRock’s Head of Digital Assets, Robert Mitchnick, the latest Bitcoin ETF surge is being driven not just by retail traders, but increasingly by institutional capital. Speaking at Token2049 in Dubai last week, Mitchnick described a clear shift in who’s fueling ETF inflows.

“At the outset, it certainly was predominantly retail,” he explained, “but now we’re seeing significant momentum from institutions and wealth advisors.” This evolution reflects Bitcoin’s growing status as a legitimate macro hedge.

Mitchnick pointed to rising U.S. Treasury yields and wavering tariff policies under the Trump administration as catalysts for the shift. In this climate, Bitcoin is being increasingly positioned as a non-sovereign store of value, capable of shielding portfolios from fiat risk and economic instability.

This renewed institutional appetite coincides with Bitcoin’s rising dominance in the crypto market, as altcoins continue to lag. It also reinforces the narrative that Bitcoin is not only the face of crypto, but now a key pillar in modern portfolio management.

Bitcoin Dominance Hits Four-Year High

Bitcoin’s market dominance has surged to its highest level since early 2021, fueled by the inflows into ETFs and waning interest in altcoins. Major tokens like Ethereum, Solana, and Dogecoin continue to trade significantly below their 2024 highs, even as ETF interest for BTC accelerates.

CoinGlass data reveals that while Bitcoin ETFs added over $1.8 billion last week, Ethereum ETFs saw only $149 million in inflows. Despite active ETH funds already being available, institutional and retail investors are overwhelmingly favoring BTC.

While there is speculation that ETFs for other tokens—like XRP or Dogecoin—might narrow the gap, Bitcoin’s consistent performance has cemented its role as the preferred digital hedge in times of economic uncertainty. With liquidity tightening and traditional markets facing volatility, BTC is increasingly seen as the safest digital asset.

Quick Facts

- Bitcoin ETFs attracted over $1.8 billion in inflows from April 28 to May 4, continuing a strong upward trend.

- BlackRock’s iShares Bitcoin Trust led the charge with $2.56 billion, while Ark 21Shares lost $458 million.

- Gold ETFs recorded $1.94 billion in outflows over the same period, deepening the divergence in investor behavior.

- For the second week running, Bitcoin outperformed gold ETFs by nearly $4 billion, signaling a major pivot in institutional strategy.