Senate Democrats are walking back support for a long-negotiated stablecoin bill following late-stage concerns about foreign regulatory gaps and alleged links to former President Donald Trump’s crypto ventures.

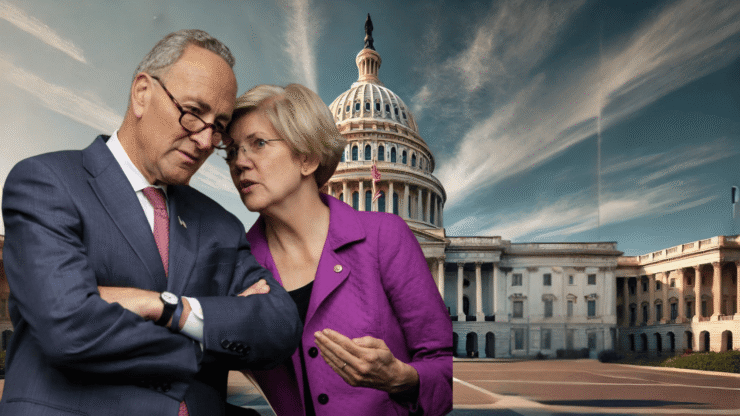

According to a new Politico report, Senate Majority Leader Chuck Schumer and Senator Elizabeth Warren led the charge against the bipartisan proposal during a private meeting on Thursday. Their intervention triggered backlash from nine Senate Democrats—four of whom had supported the bill in committee—effectively halting its progress in the upper chamber.

Schumer reportedly warned colleagues that the bill’s current language was too soft on overseas stablecoin issuers like Tether, arguing that Democrats should leverage their position to secure stronger safeguards against foreign influence.

Warren reinforced the resistance by raising ethical concerns tied to Trump’s deepening involvement in the crypto space. With reports linking Trump-affiliated entities to stablecoin ventures, Warren advocated for more scrutiny to prevent legislation that might directly or indirectly benefit the former president or his associates.

Though the meeting was not originally focused on digital assets, crypto quickly dominated the discussion as national security and partisan optics came into sharper focus. Republican aides voiced frustration over what they described as a “strategic reversal” by Democrats after months of bipartisan negotiations.

Democrats Call for Stronger Reforms in GENIUS Act

Senator Ruben Gallego and other Democratic lawmakers pushed back on the suggestion that their opposition marked a sudden pivot. On Sunday, Gallego posted on X, explaining the shift.

“This isn’t some reversal out of nowhere by Dems,” he wrote.

“The bill that was introduced for floor consideration back-pedaled on a lot of the progress we made and did not include other improvements we sought.”

The legislation, titled the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins), aims to establish a robust regulatory framework for stablecoin issuers. Its provisions include:

- Full reserve backing with cash and short-term U.S. Treasuries

- Monthly public reserve disclosures

- Annual audits for issuers with over $50 billion in circulation

Despite its core features, Democrats argue that the bill must go further—calling for national security provisions and stricter anti-money laundering (AML) enforcement. These concerns reflect ongoing scrutiny of foreign-controlled issuers like Tether and the broader risks of illicit finance in decentralized crypto markets.

While the current bill has hit a wall, lawmakers on both sides have expressed interest in finding a path forward. Sources suggest that a revised draft could emerge that balances the need for innovation with tougher oversight.

The GENIUS Act was seen as a potential cornerstone of the U.S. crypto regulatory agenda. Now, its future hinges on whether amendments can bridge partisan concerns—particularly around foreign actors, AML protections, and any financial entanglements involving Trump-affiliated ventures.

Quick Facts

- Chuck Schumer and Elizabeth Warren urged Democrats to reconsider the GENIUS Act.

- Concerns include national security risks and potential financial gains for Trump-linked firms.

- Nine Senate Democrats withdrew support, citing AML and foreign oversight gaps.

- The bill’s fate remains uncertain pending further negotiation and amendment.