Arizona’s ambitious effort to become the first U.S. state to hold Bitcoin in its official reserves has come to a halt after Governor Katie Hobbs vetoed Senate Bill 1025. The bill, known as the Digital Assets Strategic Reserve measure, proposed allowing the state to invest seized funds into Bitcoin and create a state-managed reserve—sparking national attention and fierce debate.

The proposal passed the Arizona House with a narrow 31–25 vote, reflecting growing enthusiasm among some lawmakers to integrate digital assets into public finance. But Hobbs firmly rejected the measure, warning that Arizona’s strong public retirement system should not be jeopardized by speculative strategies.

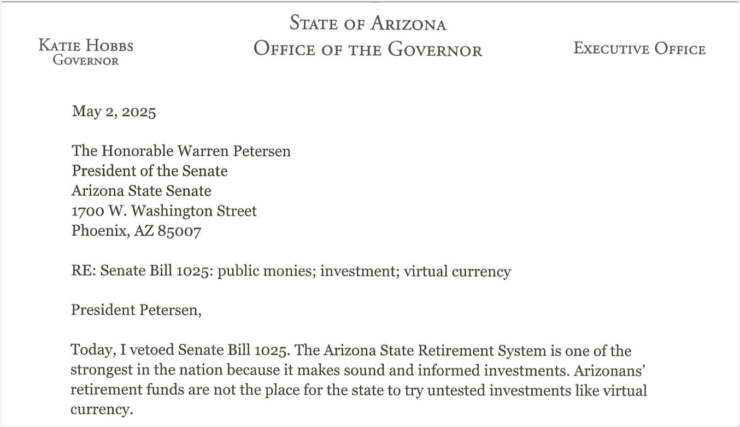

“Today, I vetoed Senate Bill 1025. The Arizona State Retirement System is one of the strongest in the nation because it makes sound and informed investments,” Hobbs wrote in her veto message.

“Arizonans’ retirement funds are not the place for the state to try untested investments like virtual currency.”

The veto is part of a broader standoff between Hobbs and pro-crypto legislators, including Arizona Senate President Warren Petersen. State Senator Wendy Rogers, a co-sponsor of the bill, had promoted Bitcoin as both a financial hedge and modernization tool, tweeting that “Arizona needs Bitcoin.”

Despite the governor’s rejection, supporters of the bill have hinted at plans to reintroduce similar legislation in future sessions, citing the long-term economic potential of a state-managed digital reserve.

Arizona Reserve Bill Dies, But Others Remain in Play

Although Governor Hobbs vetoed SB 1025, another crypto-related bill—SB 1373—remains under consideration. That proposal would allow up to 10% of Arizona’s rainy-day fund to be invested in Bitcoin and other digital assets and is still awaiting a final vote in the state legislature.

The vetoed bill had passed the Arizona House on April 28 with 31 votes in favor and 25 against. Hobbs reaffirmed her position, stating she would not sign any legislation not tied to a broader bipartisan agreement on disability funding.

Other States Struggle to Advance Bitcoin Legislation

Arizona’s decision reflects a wider trend across U.S. states grappling with how to integrate digital assets into public finance. In recent months, similar reserve-related bills in Montana, Oklahoma, South Dakota, and Wyoming have failed to advance or were withdrawn.

However, North Carolina has emerged as a potential leader in this space. The state’s House recently passed the Digital Assets Investment Act, allowing the treasurer to allocate up to 5% of select public funds into approved cryptocurrencies. That bill now awaits a Senate vote.

This state-level momentum coincides with recent federal developments. In March, President Donald Trump signed an executive order proposing the creation of a Strategic Bitcoin Reserve and a broader Digital Asset Stockpile—part of his administration’s renewed pro-crypto policy shift.

Quick Facts

- Arizona Governor Katie Hobbs vetoed SB 1025, which would have allowed the state to invest seized funds in Bitcoin.

- The bill aimed to position Arizona as a digital asset leader but was rejected over investment risk concerns.

- A separate bill, SB 1373, allowing Bitcoin investment from the state’s rainy-day fund, remains under review.

- Similar bills in other states have stalled, while North Carolina advances its own crypto proposal.