ARK Invest has significantly raised its long-term outlook on Bitcoin, unveiling a new bull-case price projection of $2.4 million by 2030—up from its previous target of $1.5 million. The revised estimate, detailed in a Thursday report by analyst David Puell, is based on ARK’s latest experimental model, which applies a more refined approach to calculating Bitcoin’s liquid supply and adoption trajectory.

The new forecast considers only actively circulating coins—excluding long-lost or dormant holdings—to reflect what ARK views as a more accurate representation of Bitcoin’s economic footprint. The model also integrates assumptions about Bitcoin’s adoption across global markets and use cases, mapping its potential against a variety of total addressable markets (TAMs).

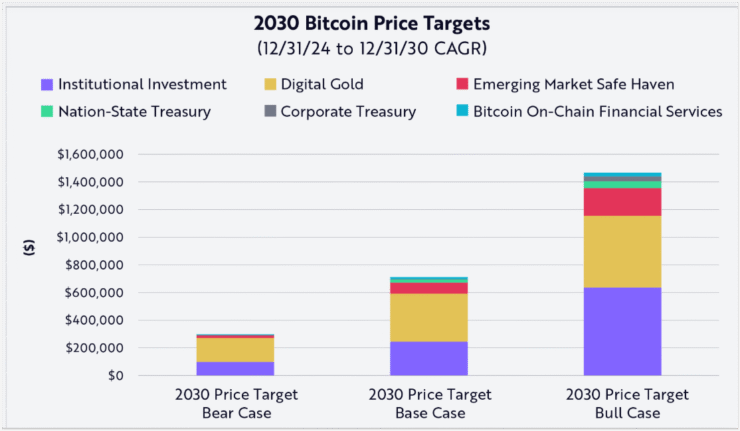

According to the report, the $2.4 million bull-case price implies a staggering 72% compound annual growth rate (CAGR) from the end of 2024 through the end of the decade. ARK’s revised base-case estimate now stands at $1.2 million by 2030 (a 53% CAGR), while even the bear case suggests Bitcoin could reach $500,000 during the same period—a 32% CAGR.

This updated model—described as more aggressive than ARK’s official framework—aligns with the firm’s high-conviction stance on Bitcoin as a transformative financial asset. CEO Cathie Wood has consistently championed Bitcoin’s potential to disrupt traditional finance, citing institutional adoption, scarcity, and a digital-first investor base as core drivers.

institutional Demand and Emerging Markets Drive Bitcoin’s $2.4M Bull Case

In the newly revised forecast, analyst David Puell identified institutional adoption and Bitcoin’s role in emerging markets as the key forces underpinning the firm’s bullish projections.

While Bitcoin’s use as “digital gold” serves as the foundation for both base- and bear-case scenarios—$1.2 million and $500,000 by 2030, respectively—it’s the expected influx of institutional capital that fuels ARK’s most ambitious outlook of $2.4 million.

“Institutional investment contributes the most to our bull case,” Puell stated, pointing to potential inflows from pension funds, sovereign wealth funds, and corporate treasuries. These players, he noted, bring capital depth and long-term conviction, helping to accelerate adoption and improve liquidity.

Bitcoin’s utility in emerging markets also figures prominently in ARK’s model. Puell emphasized that Bitcoin offers a low-barrier investment tool for individuals facing inflation, capital controls, or fiat instability. “Its low barriers to entry grant individuals with internet access an alternative store of value—potentially outperforming defensive holdings like the U.S. dollar,” he said.

Notably, ARK’s report highlights that many traditional valuation models fail to account for the true scarcity of Bitcoin—especially due to the estimated millions of coins that are permanently lost. “This more experimental exercise highlights that Bitcoin’s scarcity and lost supply are not properly priced into most current models,” Puell added.

These insights further cement ARK’s position that Bitcoin’s asymmetric upside is not merely speculative—it’s increasingly tied to global macroeconomic shifts and institutional capital flows.

Quick Facts

- ARK Invest projects Bitcoin could reach $2.4 million by 2030 in its most aggressive scenario.

- The base-case projection stands at $1.2 million, while the bear-case target is $500,000.

- Institutional investment and adoption in emerging markets are key drivers of the forecast.

- The analysis factors in lost Bitcoin supply and growing interest from ETF markets and macro-focused investors.