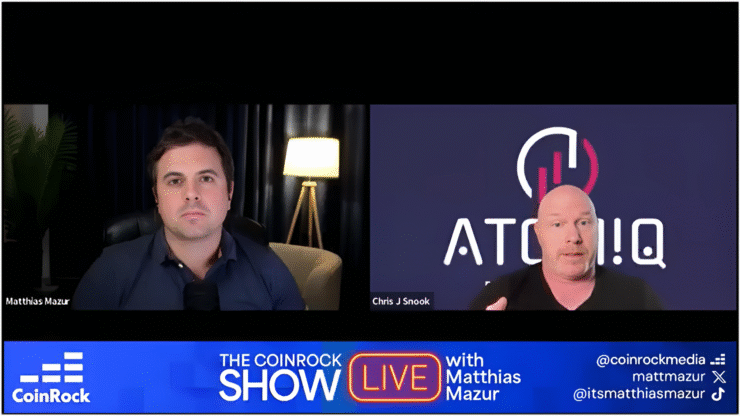

On this episode of The CoinRock Show, host Matthias Mazur is joined once again by venture strategist and media entrepreneur Chris J. Snook, who delivers a sobering but strategic take on what he calls the “Guns of April” moment. Drawing parallels between today’s escalating geopolitical landscape and historical flashpoints like World War I and the Cuban Missile Crisis, Snook paints a picture of an economic environment teetering on the edge—not necessarily of war, but of miscalculated brinkmanship.

But his core message is clear: this isn’t about doom. It’s about clarity.

“There’s the people that want to see the world as they want it to be, or as they think it should be,” Snook said.

“The reality is then, you know, smart investors and smart business people just try and look at what it actually is.”

It was a back-to-back masterclass on mindset, macro, and maneuvering through a world where rationality isn’t always the dominant force.

The Guns of April: Geopolitical Posturing and Historical Echoes

The episode kicks off with a surprising reference to Barbara Tuchman’s The Guns of August, a Pulitzer-winning book on how a series of misunderstandings, pride, and tactical missteps led to the outbreak of World War I. Snook connects this to the present-day tariff wars and international signaling games, calling it “The Guns of April.”

His point? We’re in another game of chicken—not with bullets, but with tariffs, rhetoric, and economic leverage. And the players are again pretending that escalation is a strategy rather than a liability.

“If you go outside and you want it to be sunny, but it’s, you know, a hurricane like. Well, then, you’re not gonna do the things that you would do in sun when there’s a hurricane,” he posited.

“I think there’s I think there’s strategies that are being deployed right now that in some ways I think that… maybe we’re overplaying, or maybe we’re we’re executing, not as well as we’d like, or that we’re not listening to the signals that are happening in real time.”

Snook argues that investors must study power dynamics, not punditry. The world isn’t trending toward harmony—it’s trending toward polarity, and that matters when pricing assets and predicting capital flow.

He also challenged the audience to reframe how they interpret narratives in media:

“You have to kind of put those other notions aside of how it should be, how it could be, how, how we’d like it to be. And you have to go. Well, how actually, is it right? It’s no different than.”

Throughout the episode, Snook returns to this guiding principle: investors must abandon fantasies about what the world should be and instead assess what it actually is.

This means:

- Stop moralizing the market.

- Accept that irrational actors hold power.

- Build strategies that account for disorder, not just efficiency.

It’s an uncomfortably honest framework—but one that reflects the volatility in both crypto and TradFi environments today. According to Snook, The conditions we’re dealing with are not random. They’re systemic.

He warned listeners about underestimating the effect of the current U.S. leadership’s tactics and experience, citing the possibility that aside from all the cloud of aggressive trade engagements, there was something strange, positively, about the new regime.

“There’s something different this time about this administration, and I’m not just talking about the man at the top of it,” he said.

“I think this time there was a tremendous amount of prep prior to even the decision, meaning leading all the way up until the election day. There was a lot of preparation. There was a lot of recruitment of really really smart and accomplished people.”

The Crypto Winter Thaw, Bull Cycle, and Speculative Risk

Snook didn’t hold back when asked about the state of crypto. While many shy away from market predictions, he laid out a nuanced thesis: we may be transitioning from a crypto winter to a warming spring—with both opportunity and risk on the horizon.

“And so you could make an argument that, you know, we are coming into some level of winter to spring, and then maybe spring to summer, as far as price action and valuations go.”

With increased global liquidity, devaluation of currencies, and a surge in capital printing across multiple regions, Snook believes macroeconomic conditions are primed for a strong crypto bull run within the next 6 to 24 months.

But that optimism comes with caveats:

“But I think that’s also gonna cause you know more of the negatives which mean more meme coins, more rug polls, more scammers. Because more people enter. So those are the negatives that come with that.”

He warned that many altcoin ecosystems may enjoy a brief pump but lack the activity or long-term fundamentals to survive.

Snook emphasized the growing credibility of Bitcoin as an asset class, noting that the chance of it ever going to zero is now “as close to zero as it’s ever been.”

“If it doesn’t go to zero, it’s just a matter of time before it eats a big chunk of global capital.”

He acknowledged that he personally hopes BTC stays below $100K for longer—if only to accumulate more—but believes a breakout, when it comes, will be dramatic.

Long-term, he envisions a crypto landscape where Ethereum and Bitcoin become the dominant settlement layers, possibly with fragmentation on top consolidating around a few core ecosystems.

“I still think ETH and Bitcoin are probably those two… but there’s going to be a migration to one or two operating systems for the crypto future as settlement layers.”

He even hinted at bullish developments from Cardano and Stacks, particularly those making strategic moves to interoperate with Bitcoin’s evolving stack.

Final Take: You are Still Early

Snook leaves listeners with a final note, encouraging listeners that every great monetry structure and system in establishment today took about 90 years to get to full maturity. So with crypto being only 16 years old, if you are thinking that you are late to the Bitcoin party or didn’t buy early, then think again!

“So if you think about Bitcoin, then the crypto ecosystem being 16 years old, and you’re worried about whether or not you have enough money or you’re gonna have enough time to get rich. And whatever you think that means.

“80 years from now, because it’ll be at that level of maturity. You are having to see it in the 16th year. So again a longer term, and a patient and a historical lens helps us calm down so we can just focus on what matters and speed up our actions in those steps”

Know More About Chris J. Snook

You can connect with Chris J. Snook on various social media platforms and explore his work through his official website. Here are his verified profiles:

- Official Website: chrisjsnook

- X (Twitter): @digitalsenseXYZ

- LinkedIn: Chris J. Snook on LinkedIn

- Substack: WealthMatterstome

- Minnect (Expert Advice Platform): Chris J. Snook on Minnect

- ATOM!Q (AI-Powered Venture Studio): Visit ATOM!Q