Polygon has officially taken the lead in weekly NFT sales, marking a notable power shift in the digital collectibles space. The network recorded $22.3 million in NFT volume over the past seven days, edging out Ethereum’s $19.2 million, according to data from CryptoSlam.

The surge represents a 20% week-over-week increase for Polygon and accounts for nearly a quarter of all NFT sales globally during the same period, which totaled $92.9 million. Much of this momentum is attributed to rising interest in real-world asset (RWA) NFTs—particularly those tied to physical collectibles like trading cards.

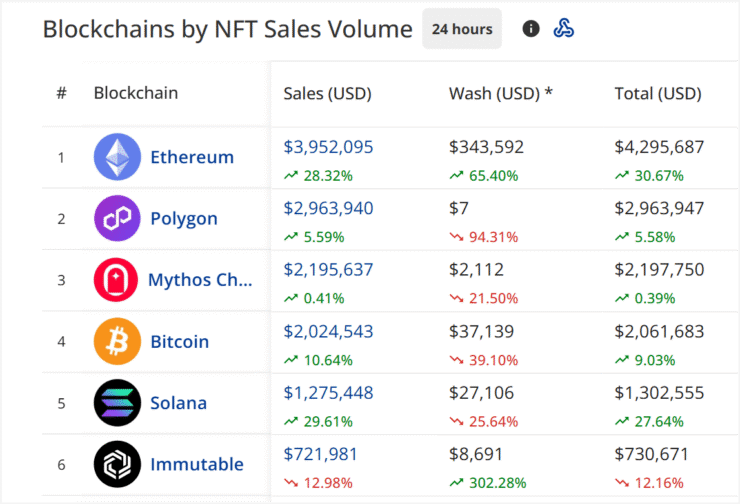

Polygon’s traction was further boosted by an 81% spike in unique NFT buyers, totaling more than 39,000 wallets for the week. Ethereum, while still dominant in legacy collections and infrastructure, fell to second place ahead of Mythos Chain and Bitcoin-based collections, which recorded $14.3 million and $14.1 million, respectively.

This data reflects a growing investor appetite for utility-driven NFTs, especially those merging physical and digital value. It also signals a maturing market that increasingly favors platforms with broader real-world applications.

Courtyard’s RWA NFTs Drive Polygon’s Surge

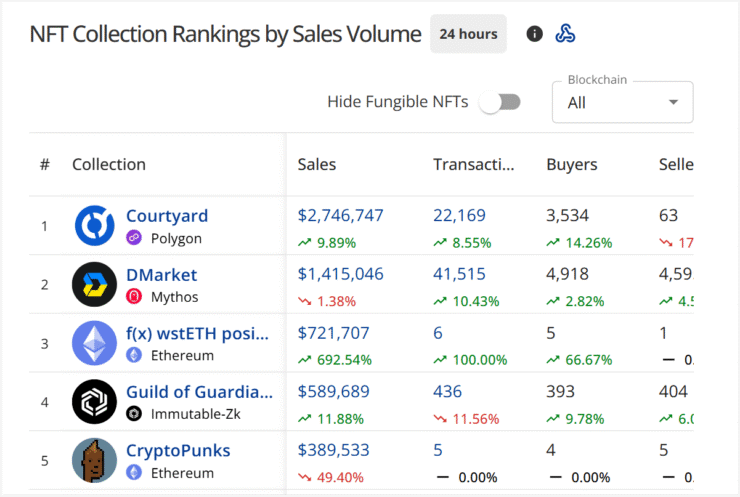

Polygon’s sharp rise to the top of the NFT sales charts can be traced to a single standout driver: Courtyard, a real-world asset NFT collection that has brought fresh energy—and serious capital—into the network.

The Courtyard platform specializes in tokenizing graded physical collectibles, transforming items like Pokémon, basketball, and baseball trading cards into blockchain-based NFTs that can be bought, sold, or redeemed. Each token is backed by a real, securely stored collectible, offering buyers both digital flexibility and tangible value.

According to CryptoSlam, Courtyard alone accounted for $20.7 million in sales last week, outperforming even the most established NFT projects across all blockchains. The project’s dominance signals a broader shift: RWA tokenization—once limited to institutional-grade assets like real estate—is now gaining strong traction in consumer-facing sectors.

With its blend of physical utility and digital accessibility, Courtyard’s breakout week may be a preview of how RWA NFTs could reshape the future of digital collecting.

RWA Tokenization Continues Its Uptrend

The success of Courtyard underscores a broader trend in the crypto industry: the accelerating growth of tokenized real-world assets. According to data from RWA.xyz, the total value of tokenized RWAs has surpassed $21.2 billion, excluding stablecoins.

RWA tokenization allows investors to gain exposure to tangible assets without the traditional barriers—such as geography, custodial limitations, or high entry costs. As platforms like Courtyard continue to innovate, the intersection of blockchain technology and physical ownership is emerging as a major growth area in the NFT space.

With liquidity, transparency, and accessibility improving across the board, RWA NFTs are well-positioned to drive the next wave of adoption in both retail and institutional markets.

Quick Facts

- Polygon NFTs recorded $22.3 million in weekly sales, overtaking Ethereum’s $19.2 million.

- Courtyard NFTs accounted for $20.7 million of Polygon’s volume, driven by tokenized trading cards.

- The number of unique buyers on Polygon surged 81%, surpassing 39,000 wallets in a week.

- Tokenized real-world assets have reached a market value of $21.2 billion, highlighting growing RWA interest.