A Brazilian court has sentenced three individuals to a combined 171 years in prison for orchestrating one of the country’s largest cryptocurrency scams. Operating under the name Braiscompany, the fraudulent investment platform promised outsized returns on Bitcoin deposits and defrauded thousands of investors out of an estimated $190 million.

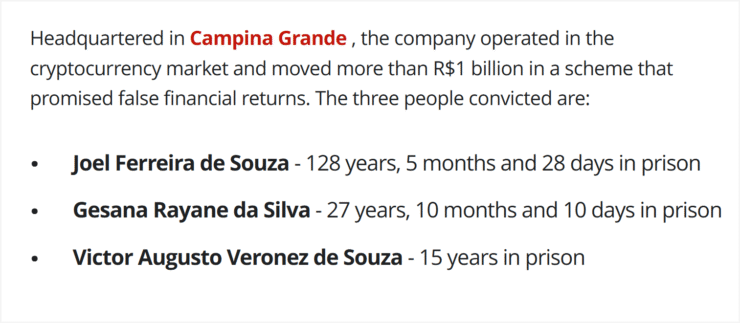

According to court records, Joel Ferreira de Souza, Gesana Rayane da Silva, and Victor Augusto Veronez de Souza were found guilty of running a criminal organization disguised as a crypto investment firm. Prosecutors identified Ferreira de Souza as the mastermind, handing him a 128-year prison sentence—the harshest among the three.

Braiscompany had been under investigation since 2021 amid allegations of pyramid scheme tactics. By 2023, Brazilian authorities launched a full criminal probe as evidence of financial misconduct mounted. The ruling marks a firm stance from Brazil’s judiciary as the country wrestles with an uptick in crypto-related fraud.

20,000 Victims, $190 Million Lost in Braiscompany Scam

Prosecutors allege that Braiscompany defrauded over 20,000 investors, stealing more than R$1.1 billion (about $190 million USD). Many victims believed they were participating in a legitimate Bitcoin investment platform and entrusted the firm with their life savings.

The convicted individuals have been ordered to repay R$36.5 million (roughly $6.2 million USD). Authorities have already seized a portion of their assets, but full restitution for victims remains uncertain given the scale of losses.

Brazil leads Latin America in crypto adoption, boasting the highest number of Bitcoin ETFs in the region and increasing institutional integration. Yet, as interest in digital assets grows, the case highlights the urgent need for stronger regulatory frameworks to prevent future abuse.

Shadow System Helped Braiscompany Conceal Ponzi Operations

At the core of the Braiscompany scheme was a shadow financial system. While publicly portraying itself as a high-yield crypto trading firm, prosecutors revealed the company operated through informal fund transfers and inflated commission structures—funneling profits to insiders while hiding the fraud.

The court ordered the seizure of R$36 million in assets. However, attorney Artêmio Picanço, who represents several victims, warned that those seeking compensation must file civil claims promptly before the recovered funds are absorbed by the state.

While two defendants were acquitted for lack of evidence, the remaining individuals were found to have knowingly engaged in laundering proceeds from the fraudulent scheme. The group’s operations imitated legitimate investment practices, but in reality, they were mechanisms to extract wealth from unsuspecting investors for personal gain.

Quick Facts

- Three individuals sentenced to 171 years in Brazil’s largest crypto fraud case

- Scam involved $190 million in investor losses and 20,000 victims

- Authorities have seized $6.2 million in assets for partial restitution

- The case highlights the need for stronger crypto regulations in Brazil