As macroeconomic tensions mount, traditional safe-haven assets are regaining favor—and Bitcoin appears to be missing the rally. In a research report published Wednesday, JPMorgan analysts said gold is attracting strong inflows from investors seeking protection, while Bitcoin is seeing waning demand and continued ETF outflows.

Led by managing director Nikolaos Panigirtzoglou, the JPMorgan team highlighted a surge in investor interest in gold across both ETF and futures markets. Gold’s reputation as a reliable hedge in volatile environments remains intact, especially as liquidity and market depth deteriorate.

“Gold continues to benefit from safe haven flows in a similar fashion to currencies like the Swiss franc and the yen,” the analysts wrote.

“These safe haven flows are seen in both the ETF and futures spaces.”

Meanwhile, Bitcoin’s “digital gold” narrative is under strain. The analysts pointed to reduced speculative interest in Bitcoin futures and three consecutive months of outflows from spot Bitcoin ETFs. The trend suggests investors are not turning to BTC as a hedge in times of uncertainty—they’re moving away from it.

The growing divergence between gold and Bitcoin reflects a broader sentiment shift. Gold is attracting capital amid inflation fears, geopolitical instability, and expectations of market corrections. While Bitcoin has historically delivered outsized returns, its volatility and limited adoption as a safe-haven asset remain hurdles to mainstream acceptance.

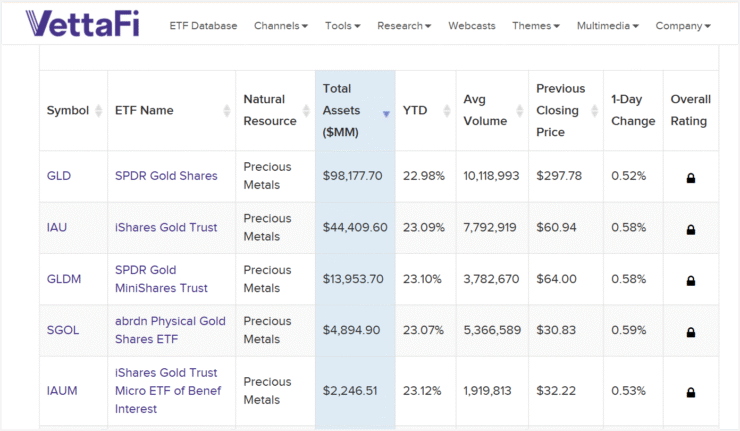

Gold ETF Inflows Surge as Bitcoin Lags Behind

The global gold exchange-traded funds (ETFs) recorded $21.1 billion in net inflows during Q1 2025, according to data from the World Gold Council cited in the JPMorgan’s report seen by TheBlock. Notably, $2.3 billion came from Chinese and Hong Kong ETFs—evidence of rising demand for gold in Asia amid economic uncertainty.

The $21.1 billion figure represents 6% of global gold ETF assets under management (AUM). However, in China and Hong Kong alone, that figure jumps to 16%, highlighting the region’s accelerating appetite for the metal.

Gold’s rally isn’t just driven by passive flows. JPMorgan analysts also noted an uptick in speculative futures positioning since February, which has helped push prices higher.

Bitcoin, in contrast, has failed to capture similar flows or sentiment. Despite escalating geopolitical and financial risk factors, the asset has not benefited from the broader safe-haven shift. With spot ETF outflows and subdued futures activity, Bitcoin remains an outlier in the macro-driven narrative.

Earlier this month, JPMorgan analysts flagged $62,000—Bitcoin’s estimated production cost—as a key technical support level. Despite challenges to its safe-haven image, Bitcoin continues to trade above that mark, sitting near $84,300 at the time of writing, reflecting a modest 0.5% gain over the last 24 hours.

Quick Facts

- JPMorgan says Bitcoin’s “digital gold” narrative is weakening

- Gold leads the safe-haven trade with rising ETF inflows

- Bitcoin’s $62,000 production cost seen as key support

- Bitcoin trades near $84,300, up 0.5% in 24 hours