President Donald Trump reignited tensions with Federal Reserve Chair Jerome Powell on Thursday, blasting him for not cutting interest rates sooner and demanding his swift departure from office. The sharp comments come as global markets react to Trump’s escalating tariff measures and rising economic uncertainty.

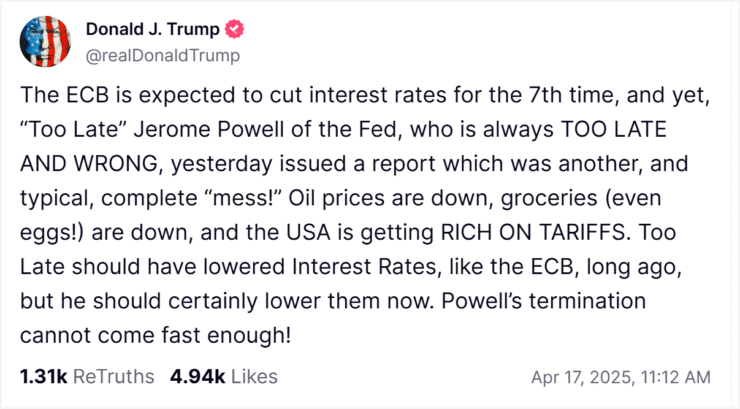

In a Truth Social post, Trump labeled Powell as “always TOO LATE AND WRONG,” criticizing his hesitation to reduce borrowing costs in line with central banks like the European Central Bank (ECB), which is expected to announce rate cuts this week. “Powell’s termination cannot come fast enough!” Trump declared.

The attack coincides with broader market unease following Trump’s announcement of steep reciprocal tariffs targeting dozens of U.S. trading partners. Although the administration later introduced a 90-day suspension on the tariffs, the move has already sent ripples through financial markets and heightened pressure on monetary policymakers.

With the Federal Reserve’s next rate decision approaching in May, Powell now faces mounting political heat as he navigates rising inflation and slowing growth—two outcomes that Trump’s trade war may be accelerating.

Powell Warns Tariffs Threaten Fed’s Dual Mandate

Federal Reserve Chair Jerome Powell warned this week that President Donald Trump’s aggressive tariff strategy could place the U.S. economy in a precarious position—complicating the Fed’s efforts to balance inflation control with job growth.

Speaking Wednesday, Powell said the tariffs imposed by the Trump administration were “significantly larger than anticipated,” and risk creating a scenario where the central bank’s dual mandate—price stability and maximum employment—becomes harder to achieve simultaneously. His comments arrive just weeks ahead of the Fed’s next policy meeting in May.

Trump, who appointed Powell in 2018, has repeatedly criticized the Fed chair for not cutting interest rates more aggressively. Earlier this month, the president posted on Truth Social: “CUT INTEREST RATES, JEROME, AND STOP PLAYING POLITICS!” Despite the ongoing friction, Trump said in a December interview that he had no intention of removing Powell before his term ends in May 2026.

Despite Trump’s latest tirade and Powell’s economic warning, markets remained composed. Futures pointed to a 0.5% rise in the S&P 500 at the open, and the yield on the 10-year U.S. Treasury edged up to 4.31%, suggesting investor sentiment has yet to crack under the mounting political pressure.

Quick Facts

- Trump slammed Fed Chair Jerome Powell for delaying interest rate cuts, calling him “always TOO LATE AND WRONG.”

- The president demanded Powell’s early exit, saying his “termination cannot come fast enough.”

- Trump’s steep tariffs on U.S. trading partners rattled markets, despite a 90-day pause.

- Powell warned tariffs may worsen inflation and slow job growth ahead of the Fed’s May meeting.