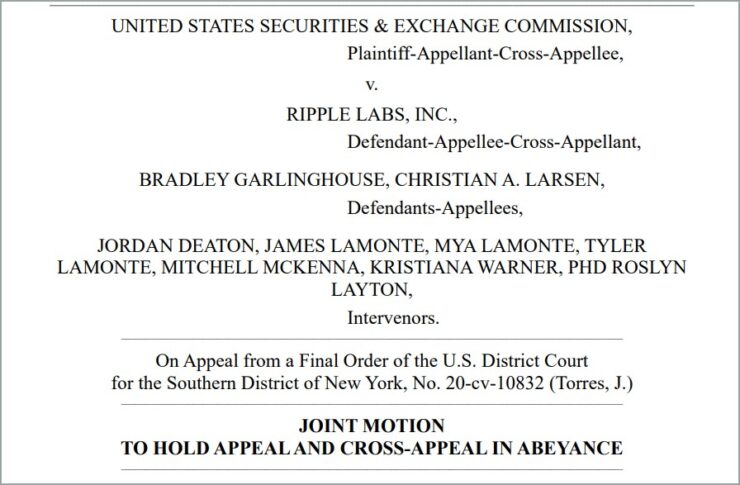

Ripple Labs and the U.S. Securities and Exchange Commission (SEC) have filed a joint motion to pause their respective appeals as they work toward finalizing a negotiated settlement in one of the most consequential legal battles in U.S. crypto history.

According to the filing with the U.S. Court of Appeals for the Second Circuit, both parties have reached an agreement-in-principle to resolve the long-standing dispute, though final SEC approval remains pending. This marks the first formal confirmation that Ripple and the SEC are actively seeking to end the case through a mutual resolution, following months of speculation and public hints by Ripple executives.

“The parties require additional time to obtain Commission approval for this agreement-in-principle,” the filing reads.

The timing coincides with a major leadership transition at the SEC. Paul Atkins, recently confirmed as SEC Chair under President Trump, is expected to be sworn in within days. The change in leadership has already spurred expectations of a more crypto-aligned regulatory posture, with industry observers anticipating a wave of settlement agreements and enforcement reversals.

Ripple-SEC Standoff Nears Resolution After Years of Legal Uncertainty

The legal clash between Ripple and the SEC began in December 2020, when the agency alleged that Ripple raised $1.3 billion through unregistered securities offerings via its XRP token. The case rattled crypto markets, prompted exchange delistings, and became a flashpoint for broader debates about the SEC’s role in regulating digital assets.

A major breakthrough came in July 2023, when U.S. District Judge Analisa Torres ruled that Ripple’s programmatic sales of XRP on secondary markets did not constitute securities offerings—though the ruling maintained that institutional sales of XRP did violate securities laws. The decision was widely viewed as a partial victory for Ripple and a turning point in the case.

The SEC responded by appealing key aspects of the ruling, including its claims against Ripple CEO Brad Garlinghouse and Executive Chairman Christian Larsen. Those appeals are now being voluntarily withdrawn under the emerging settlement structure.

Once finalized, the settlement would bring a historic regulatory battle to a close—offering long-sought clarity around token classification and providing a roadmap for future industry oversight.

Market Responds with Optimism as XRP Rallies

The news of a potential settlement has buoyed investor sentiment. Since President Trump’s re-election in November 2024, XRP has rallied over 300%, driven by expectations that the new administration will bring a more favorable regulatory environment for digital assets.

XRP’s continued climb reflects renewed optimism around its legal status, particularly as the settlement would eliminate the looming uncertainty around Ripple’s compliance obligations and the token’s classification under U.S. securities law.

Industry insiders believe a successful resolution could serve as a template for resolving other token-related enforcement actions, especially as new legislation around stablecoins and digital commodities works its way through Congress.

Quick Facts

- Ripple and the SEC have agreed to pause their appeals as they finalize a settlement.

- The case began in December 2020 over alleged unregistered securities sales via XRP.

- A partial court ruling in July 2023 favored Ripple, but the SEC pursued further appeals.

- A final settlement is pending SEC Commission approval and could set a precedent for future crypto regulation.