Ethereum led crypto markets higher on Thursday, climbing more than 9% in the past 24 hours after the Trump administration announced a 90-day pause on new tariff enforcement. The relief rally was further fueled by a softer-than-expected U.S. inflation report, which hinted at a possible shift toward looser monetary policy later this year.

As of Thursday morning, Ethereum was trading just above $1,500—though price action remained volatile, briefly dipping 0.4% in the past hour at press time.

Bitcoin also rallied 6.1% over the same period, helping push the total crypto market cap up 4.2%, according to CoinGecko. Yet it was the altcoin sector that saw the strongest moves: XRP jumped 11.5%, while Dogecoin and Solana added 6.7% and 8.4% respectively.

ETF Outflows Continue

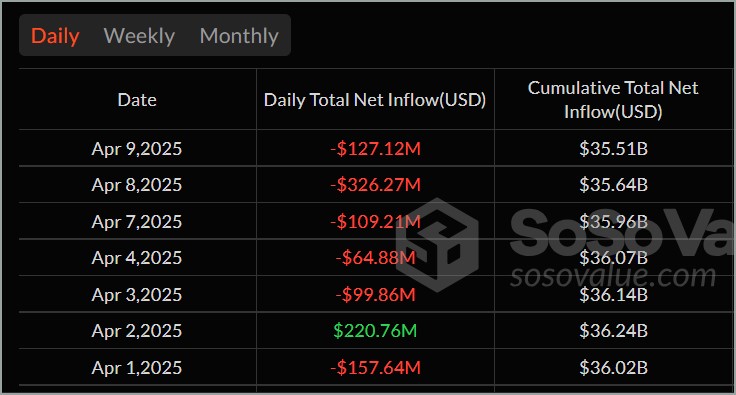

While crypto prices surged across the board following macroeconomic relief, institutional investors aren’t yet fully convinced. On Wednesday, Bitcoin exchange-traded funds (ETFs) saw $127.2 million in net outflows—marking the fifth consecutive day of capital flight from the sector, according to data from SoSoValue.

BlackRock’s flagship IBIT ETF led redemptions with $89.7 million withdrawn, signaling that even the largest institutional players are exercising caution. Bitwise’s BITB was the only Bitcoin fund to record net inflows, attracting $6.7 million.

Ethereum funds didn’t fare any better. Despite ETH’s nearly 9% rebound, Ethereum-based ETFs recorded $11.2 million in outflows on the day—underscoring a disconnect between spot market enthusiasm and institutional positioning.

This recent trend reflects growing hesitation among big-money investors, many of whom remain sidelined amid lingering geopolitical volatility and broader economic uncertainty, even as retail and altcoin traders return with renewed appetite.

Sentiment Turns Bullish Despite ETF Redemptions

Despite persistent outflows from institutional crypto products, retail sentiment around Bitcoin and Ethereum appears to be turning a corner. On-chain metrics and prediction markets suggest traders are regaining confidence in the short-term trajectory of major cryptocurrencies.

Data from Myriad, a popular prediction platform, shows that 93% of users are currently betting on Bitcoin to break above $78,000 by the close of April 10. The overwhelmingly bullish outlook suggests traders are expecting follow-through on recent macro-fueled momentum.

Meanwhile, the Crypto Fear & Greed Index—a widely tracked sentiment gauge—has shifted from “Extreme Fear” to “Fear” following President Trump’s 90-day tariff pause. Though caution remains in the air, the index’s movement signals an easing of the anxiety that’s loomed over markets in recent weeks.

With inflation showing signs of cooling and macro headwinds temporarily softening, crypto’s next move may hinge on whether retail optimism can sustain through the volatility—and whether institutions are ready to follow.

Quick Facts

- Ethereum’s price rose over 9% to trade above $1,500 after the U.S. announced a 90-day tariff suspension.

- The latest U.S. inflation report showed moderating pressures, boosting investor confidence in risk assets.

- Bitcoin and altcoins like XRP, Dogecoin, and Solana also posted significant gains, contributing to a 4.2% rise in total crypto market capitalization.

- The Crypto Fear & Greed Index moved from “Extreme Fear” to “Fear,” signaling a modest improvement in investor sentiment.