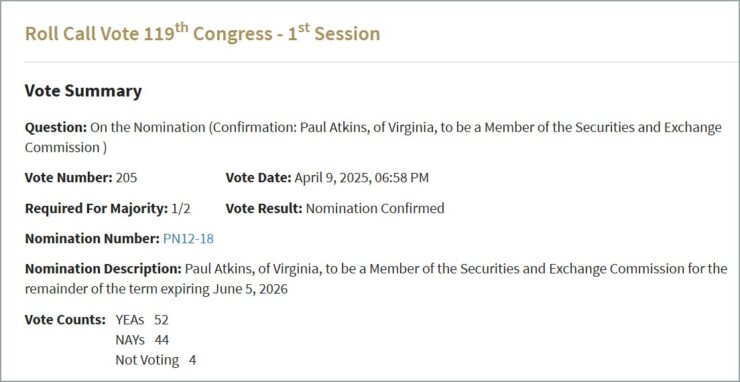

Paul Atkins, a veteran securities regulator and vocal advocate for digital asset reform, has been confirmed as the next Chair of the Securities and Exchange Commission. The Senate approved his nomination in a 52–44 vote late Wednesday, with Republicans supporting the pick and Democrats largely opposing.

Atkins, who served as an SEC commissioner from 2002 to 2008, was nominated by President Trump to succeed former Chair Gary Gensler. His confirmation marks a major shift in regulatory philosophy at the SEC—away from Gensler’s aggressive, enforcement-led approach, which drew widespread criticism from the crypto industry for its sweeping lawsuits and lack of clear rulemaking.

Atkins has pledged to prioritize a more structured and transparent regulatory framework for digital assets, signaling a break from the combative posture of the previous administration. His arrival is expected to ease tensions between the SEC and crypto firms, many of whom have spent years battling the agency over alleged securities law violations.

Atkins Brings Crypto Investment Ties to SEC Role

The newly confirmed SEC Chair is expected to usher in a dramatically different regulatory era for digital assets—one shaped by both his policy philosophy and his personal financial ties to the crypto space.

A former commissioner under President George W. Bush, Atkins told lawmakers during his confirmation process that his top priority will be establishing a “rational, coherent, and principled” framework for digital assets. He emphasized the need for clarity over confrontation, a stance that sharply contrasts with the litigious approach under his predecessor, Gary Gensler.

Ethics disclosures submitted prior to his confirmation reveal that Atkins holds substantial financial exposure to the crypto industry. He maintains up to $5 million in a digital asset investment fund as a limited partner. Until February, he also held equity stakes of between $250,000 and $500,000 in Anchorage Digital—a federally regulated crypto custodian—and in Securitize, a blockchain firm backed by BlackRock, where he previously served on the board and held options contracts.

These connections are likely to heighten both industry optimism and public scrutiny as Atkins begins shaping the SEC’s next chapter. While supporters welcome his hands-on understanding of the crypto ecosystem, critics may raise concerns over potential conflicts of interest as new policy directions emerge.

Crypto-Friendly Shift Accelerates at Partially Staffed SEC

Even before Paul Atkins’ confirmation, the SEC had already begun pivoting toward a more crypto-friendly posture—led by its remaining Republican commissioners.

Acting Chair Mark Uyeda and Commissioner Hester Peirce have moved swiftly in recent months to dismantle several high-profile enforcement actions initiated under Gensler. In a sharp departure from the agency’s previous approach, the pair has signaled intent to walk back lawsuits targeting major crypto firms and has publicly affirmed that categories such as meme coins, stablecoins, and mining operations should fall outside the SEC’s traditional securities remit.

Currently, the Commission is operating with only three sitting members: Uyeda, Peirce, and Democrat Caroline Crenshaw—well short of its full five-member capacity. Crenshaw, a staunch supporter of Gensler-era enforcement, has found herself increasingly isolated in recent votes. Her renomination was quietly shelved by Senate Democrats late last year following vocal opposition from crypto advocacy groups.

Under longstanding SEC rules, no more than three commissioners from the same political party may serve simultaneously. As a result, President Trump will eventually be required to nominate two Democrats to fill the remaining seats—though for now, the imbalance has allowed Republican leadership to steer the agency’s agenda with minimal resistance.

Atkins’ arrival further solidifies this shift. But with a leaner staff and an ideologically lopsided bench, the SEC now faces the twin challenge of rebuilding its internal ranks while recharting its regulatory approach to digital assets.

Quick Facts

- Paul Atkins has been confirmed as SEC Chair in a 52–44 Senate vote, succeeding Gary Gensler.

- Atkins has pledged to establish a rational, transparent framework for digital asset oversight.

- Ethics disclosures reveal Atkins holds significant stakes in crypto firms and funds.

- The SEC, currently down to three commissioners, is rapidly shifting toward a pro-crypto regulatory stance.