As trade tensions mount and the U.S. dollar faces fresh pressure, Bitwise Chief Investment Officer Matt Hougan believes Bitcoin could emerge as a major beneficiary. In a note to clients this week, Hougan said the Trump administration’s aggressive tariff strategy appears designed to weaken the dollar—even if it risks diminishing its status as the world’s reserve currency.

“It’s hard to be an investor at times like this. The market is volatile, and the news flow is constant,” Hougan wrote.

“The underlying message is clear: The dollar needs to go lower. So when it comes to the tariff push, the thing I’m most certain of is this: The Trump administration wants a significantly weaker dollar, even if it means sacrificing the dollar’s role as the world’s sole reserve currency.”

Hougan anticipates that this push for a softer dollar will bolster demand for “hard money” alternatives like Bitcoin—digital assets that aren’t subject to centralized monetary policy. Despite recent market volatility and global investor unease, Bitwise is sticking with its bold forecast: a $200,000 price target for BTC by the end of 2025.

The broader crypto market—like equities and other risk assets—has remained choppy amid the tariff war, but Hougan sees these geopolitical shocks as part of a long-term shift. As faith in fiat currencies erodes amid fiscal engineering and cross-border economic retaliation, decentralized assets may attract renewed interest from both retail and institutional investors seeking a more insulated store of value.

Bitcoin Seen as Anchor in Shifting Reserve Landscape

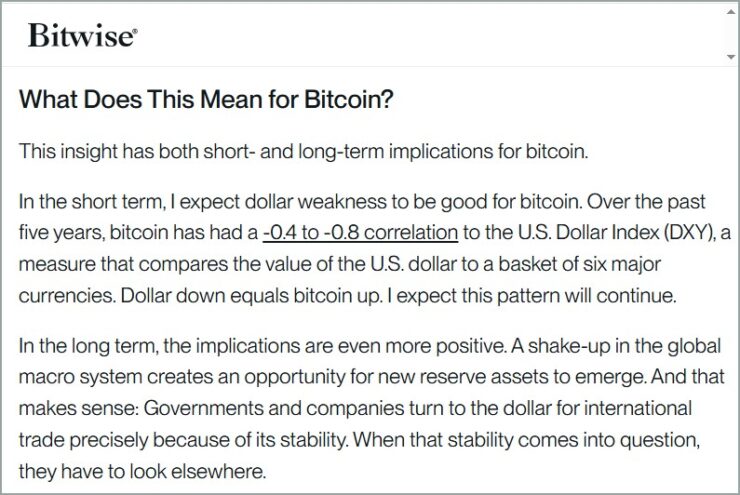

Hougan pointed out that since 2020, Bitcoin has tended to rally when the U.S. Dollar Index (DXY) dips, and he expects that inverse relationship to persist.

“Dollar down equals Bitcoin up,” he noted, reinforcing his thesis that BTC thrives amid currency instability.

But it’s the long-term view that carries the most weight. Hougan believes we’re heading toward a fragmented reserve system, where traditional fiat dominance gives way to a more diversified basket of stores of value. In that environment, Bitcoin—and gold—could see new roles emerge as decentralized hedges in a world seeking alternatives to politically controlled monetary regimes.

“In this context, the case for Bitcoin is simple: When international dynamics are fraught and global currencies are in flux, where else can investors go for a scarce, global, digital store of value that sits outside the control of any government or entity?” Hougan wrote.

While Bitcoin slipped more than 4% to trade under $77,000 following China’s tariff announcement, Bitwise remains firm on its $200,000 price target by year’s end.

This thesis echoes a growing belief across institutional circles that Bitcoin is maturing from a speculative asset into a structural fixture in global finance—one that could eventually sit alongside sovereign bonds and gold in reserve portfolios.

Beyond Bitcoin, the broader cryptocurrency market is seeing increased institutional interest and adoption. Financial instruments such as Bitcoin ETFs are gaining traction, providing traditional investors with more accessible avenues to engage with digital assets. This growing acceptance suggests a maturing market that could become more resilient to geopolitical and macroeconomic disruptions.

Quick Facts

- Bitwise CIO Matt Hougan says the Trump administration’s tariff strategy is designed to weaken the U.S. dollar.

- Hougan believes a weaker dollar will drive renewed demand for “hard money” assets like Bitcoin.

- Bitwise maintains its $200,000 year-end price target for BTC despite current market volatility.

- Ongoing trade tensions and global de-dollarization could strengthen Bitcoin’s long-term appeal as a reserve asset.