An Ether investor who had a large position on decentralized finance (DeFi) lending platform Sky has been liquidated to the tune of more than $100 million as the price of Ether crashed during a sharp market downturn.

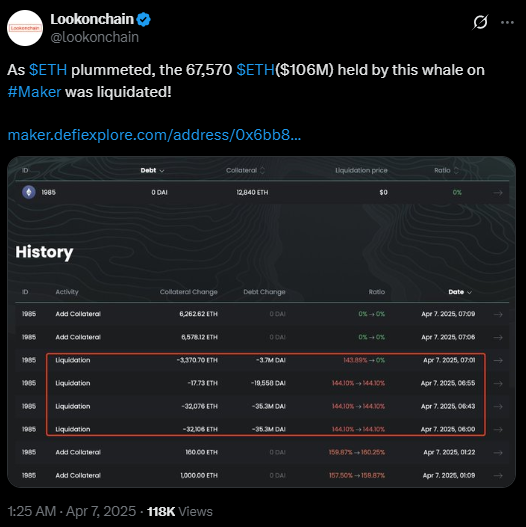

The whale lost 67,570 ETH—worth around $106 million- when the price of ETH dropped by approximately 14% on April 6, triggering the liquidation of a collateralized debt position on Sky, according to data from DeFi Explore and reports by Lookonchain.

Sky, formerly known as Maker before rebranding in August 2024, allows users to lock up ETH as collateral to borrow the platform’s stablecoin, DAI, using an overcollateralized lending model.

Like its predecessor, Sky requires users to maintain a collateralization ratio, typically at 150% or higher, meaning that for every 100 DAI borrowed, at least $150 in ETH must be held as collateral. If the market value of ETH drops and the ratio falls below the required threshold, the loan becomes eligible for automatic liquidation.

This liquidation occurred when the whale’s ratio fell to 144%, triggering the protocol to seize and auction off the ETH to cover the outstanding DAI debt and associated fees.

According to Sky’s protocol, any remaining ETH after repayment is returned to the user, but in such a large-scale liquidation, losses are significant.

Another Whale Close to the Edge

On-chain analytics platform Spot On Chain reported that another major Sky user, who had supplied 56,995 wrapped ETH (wETH)—worth about $91 million—to borrow DAI, was on the brink of liquidation as well.

The liquidation coincides with a major downturn in the crypto market. Over the past 24 hours, ETH has fallen 14.5%, dropping to $1,547—a price point not seen since October 2023, during the depths of the post-FTX bear market.

ETH remains down 68% from its all-time high in 2021, and unless the price rebounds quickly, more leveraged DeFi users may find themselves forced to either add collateral or face liquidation.

The broader downturn has been widely attributed to growing economic fears sparked by U.S. President Donald Trump’s tariff policies, which triggered a sell-off across both traditional and crypto markets.

The Ether whale wasn’t alone. Data from CoinGlass shows that over 320,000 traders were liquidated in the past 24 hours, totaling nearly $1 billion in losses.

ETH-related positions accounted for the majority of recent liquidations, reflecting how hard the asset was hit in the latest drawdown.

Volatility Meets Leverage

The $106 million liquidation on Sky serves as a stark reminder of the risks involved in overleveraging within volatile DeFi environments. While platforms like Sky offer powerful tools for capital efficiency, they come with high exposure to market swings.

With ETH at multi-month lows and market uncertainty high, risk management has never been more critical, especially for whales playing with enormous leverage.