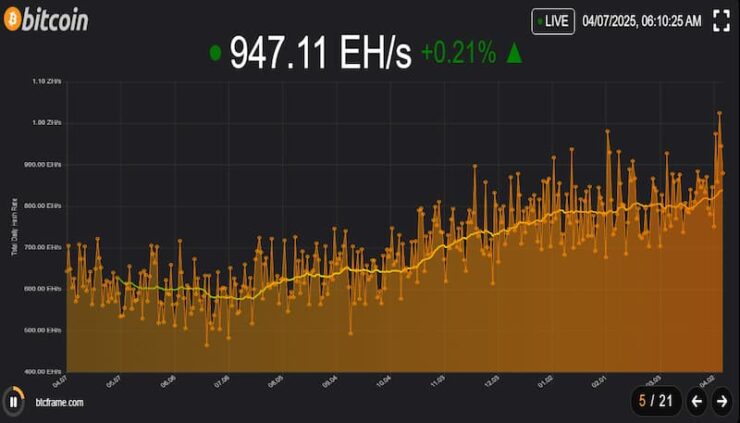

The Bitcoin network hashrate has topped 1 Zettahash per second (ZH/s) for the first time in Bitcoin’s 16-year history, according to several blockchain data sources—marking a major milestone in the evolution of the world’s largest cryptocurrency.

Data from mempool.space shows that Bitcoin’s hashrate peaked at 1.025 ZH/s on April 5, while BTC Frame recorded a similar figure the day before. Meanwhile, Coinwarz indicated that Bitcoin’s hashrate soared as high as 1.1 ZH/s on April 4 at block height 890,915, also noting that the 1 ZH/s mark may have first been breached back on March 24.

The discrepancy across data providers is due to different methodologies used to calculate hashrate. Variations in block times, difficulty adjustments, and the mining pools or node sources sampled can all shift the results.

Bitcoin cypherpunk Jameson Lopp previously noted that using just one trailing block to estimate hashrate instead of five can swing results by over 0.04 ZH/s.

“Viewing the raw Hashrate metric can be deceiving due to random variations in block times,” added Mitchell Askew, head analyst at Blockware Solutions, who noted in message to Cointelegarph that the 30-day moving average still hovers around 0.845 ZH/s.

A Major Network Milestone

Regardless of the discrepancies, the crossing of 1 ZH/s is a landmark moment for Bitcoin. One zettahash is equal to 1,000 exahashes, making this the most powerful the network has ever been.

It’s also a testament to Bitcoin’s long-term growth: the network has scaled 1,000x since hitting 1 EH/s in January 2016.

The leap reflects a rise in network security and decentralization, making it significantly harder for any malicious actor to attempt a 51% attack. It also highlights the increasing industrialization of mining, with more powerful hardware and larger-scale facilities coming online.

According to Askew, the rise in hashrate is being driven by commercial miners scaling aggressively, plugging in new hardware and expanding operations.

“Miners are doubling down: expanding sites and plugging in more efficient machines,” he said. But he also warned that less efficient miners may struggle to stay profitable if Bitcoin’s price doesn’t rebound soon.

MARA Holdings currently leads the industry with over 50 EH/s of compute power, while mining pools Foundry USA and AntPool maintain the largest share of network hashrate.

In total, at least 24 publicly listed companies are engaged in Bitcoin mining, including Riot Platforms, Core Scientific, CleanSpark, Hut 8 Mining, and TeraWulf.

The network milestone came amid a sharp market downturn. Bitcoin has dropped nearly 10% in four days, falling to $76,711, while U.S. stocks lost $6.6 trillion on April 3–4—the largest two-day loss in history.

The broader sell-off has been fueled by fears of a recession, driven by President Donald Trump’s aggressive tariff plans and their ripple effects across global markets.

Network Strong, Sentiment Shaken

While Bitcoin’s price continues to face downward pressure, the network itself has never been stronger. The hashrate surpassing 1 Zettahash shows that, despite market volatility, infrastructure and adoption at the mining level continue to advance.

With more industrial miners entering the space and efficiency ramping up, Bitcoin’s backbone is more secure and resilient than ever, even as the markets test its resolve.