Whales are intensifying their bearish stance across the cryptocurrency market, with data indicating a growing divergence between large investors and retail traders. According to analysis by Alphractal, the Whale vs Retail Delta (WvR Delta) for Bitcoin is now at 0.15—a level signaling significant caution among whales, who are increasingly positioning for a market downturn.

The divergence suggests that while smaller retail investors may be holding or buying, whales are actively reducing exposure or betting against the market.

This analysis was conducted by DarkFost, who identified the divergence using data from Alphractal. This behavior, historically a precursor to market corrections, is reinforced by recent chart analysis showing a consistent bearish trend in whale behavior.

Whale Positioning Signals BTC Downturn

The first chart in Alphractal’s data we will look at tracks the WvR Delta for Bitcoin. The blue line, representing whale positioning, remains suppressed around 0.15—near the lowest levels in the observed timeframe. Meanwhile, Bitcoin’s price action, shown as a black line, trends sideways to slightly downward.

This alignment between low whale delta and weak price movement indicates that whales are not participating in minor rallies. Instead, they appear to be hedging or shorting during brief upticks. “Whales aren’t buying into any relief rallies,” the analyst noted, pointing to a lack of bullish conviction.

The red dotted line, which represents the average WvR Delta across all cryptos, has dipped even lower than Bitcoin’s. The widening gap between Bitcoin and altcoins suggests a deeper level of bearishness in the broader market.

Altcoin Sentiment Shows Sector-Wide Weakness

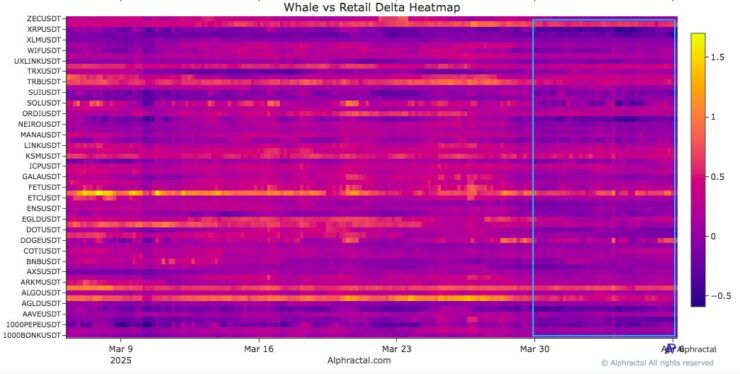

A second chart—a heatmap from Alphractal—reveals an even more pronounced trend among altcoins. Post-March 30, the map shifts uniformly blue and purple, signaling sustained whale shorting across a broad range of assets. Tokens such as ETCUSDT, DOGEUSDT, and ARKUSDT show intense bearish pressure.

The consistency of dark blue tones across rows in the heatmap illustrates that this isn’t limited to a handful of tokens. It reflects a market-wide reduction in risk appetite from large players. “Whales are exiting or shorting higher-risk assets first,” the analysis notes, emphasizing a broader deleveraging trend.

The trend is especially visible in the most recent data, where the cooler tones become more concentrated. This shift marks a deepening lack of whale confidence and suggests potential positioning ahead of market-moving events.

Retail Traders Diverge From Market Leaders

Retail traders appear to be on the opposite side of the market, continuing to hold or add long positions while whales reduce risk. Historical behavior supports the idea that retail typically enters late and exits during panic phases. The current WvR Delta implies that whales are front-running potential downside moves.

The combination of low delta, sector-wide bearish heatmap signals, and a flat-to-declining price trend suggests a high probability of further weakness. “It’s usually wiser to trade with the trend rather than against it,” the analyst concluded, adding that when delta and trend align, the risk-reward for bullish positions narrows substantially.

The data suggests whales are not merely cautious—they are actively preparing for more volatility, especially in the altcoin sector.