First Trust Advisors has launched two new Bitcoin ETFs designed to give investors exposure to Bitcoin with less risk and more flexibility.

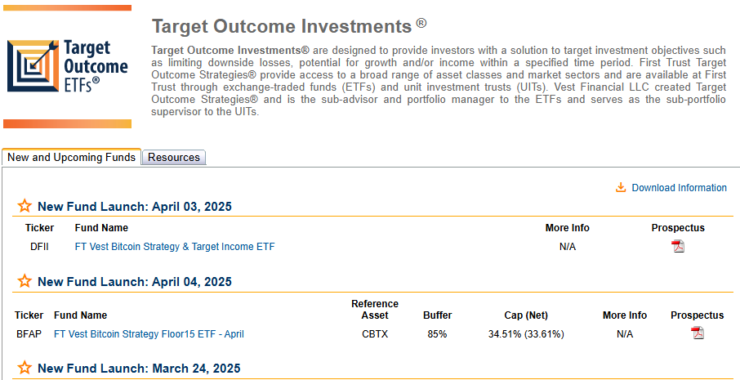

The asset manager introduced the FT Vest Bitcoin Strategy Floor15 ETF (BFAP) and the FT Vest Bitcoin Strategy & Target Income ETF (DFII)—two structured products built to reduce downside volatility and offer yield, while still tracking Bitcoin’s market performance.

The move comes as interest in crypto ETFs continues to grow, especially among traditional investors looking for safer ways to enter the market.

The BFAP fund is designed to track the price of Bitcoin up to a capped upside while limiting potential losses. According to First Trust, it aims to reduce drawdowns by around 15%, offering more peace of mind for cautious investors.

“Over the past few years, investors have shown a remarkably strong appetite for bitcoin-linked ETFs, but the potential for sharp drawdowns has kept many on the sidelines,” said Ryan Issakainen, an ETF strategist at First Trust.

BFAP uses options-based strategies to hedge against downside risk, helping investors manage volatility while still participating in the broader gains of Bitcoin.

Generating Income from Bitcoin’s Volatility

The DFII fund takes a different approach. It seeks to generate income by selling call options on Bitcoin, capitalizing on the asset’s price swings. The goal is to offer returns that beat short-term U.S. Treasury yields by at least 15%.

This actively managed fund provides partial Bitcoin exposure while offering consistent income generation, making it attractive to yield-seeking investors.

“The DFII fund is designed to take advantage of Bitcoin’s high volatility to generate income,” Issakainen explained.

Bitcoin ETFs, particularly spot-based products, have gained significant traction since their launch in January 2024. As of April 4, total assets under management (AUM) in spot Bitcoin ETFs sit at around $93 billion, according to data from Bitbo.

Structured ETFs like BFAP and DFII are part of a broader trend where asset managers develop creative ways to offer crypto exposure with built-in guardrails.

Grayscale recently joined the trend, launching two Bitcoin strategy ETFs that also use derivatives to manage risk and generate income. Bitwise, another major player, rolled out a fund that holds shares in companies with large Bitcoin reserves—another alternative route for investors looking to bet on Bitcoin without holding it directly.

Market Volatility Still a Concern

Despite growing interest, crypto ETFs are still affected by broader market swings. On April 3, spot Bitcoin ETFs saw nearly $100 million in outflows after U.S. President Donald Trump announced a wave of new tariffs, sparking global market jitters.

Still, the rollout of more customized Bitcoin funds like those from First Trust suggests investor demand is evolving. The market is now looking not just for access to Bitcoin, but for smarter, more stable ways to interact with it.