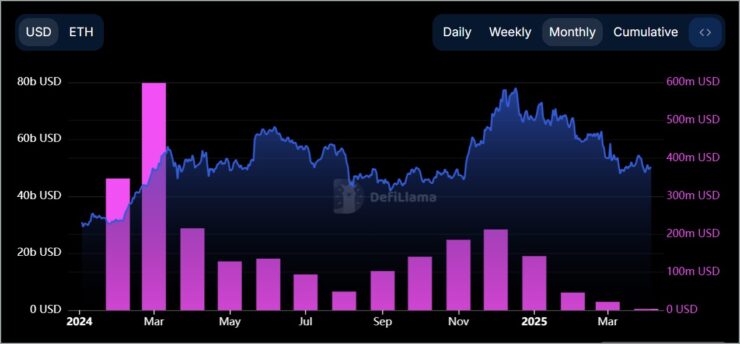

Ethereum’s network is undergoing a fundamental economic shift, as fee revenues plunge to levels not seen in over three years—without any corresponding drop in transaction volume. According to recent data, the network is now generating less than $500,000 in daily fee revenue on a seven-day moving average, a dramatic fall from its March 2024 peak of $30 million per day.

Despite this steep decline, user activity on the blockchain remains remarkably consistent. Ethereum continues to process around 1.2 million transactions daily, indicating that the drop in fee revenue isn’t due to a lack of use, but rather a profound structural change in how the network operates and scales.

At the center of this transformation is EIP-4844—also known as Proto-Danksharding—which introduced a new class of data structures called “blob” transactions. These innovations are specifically designed to reduce data availability costs for Layer 2 rollups, Ethereum’s leading scaling solution. As a result, rollups are now able to operate more efficiently and pass on cost savings to users.

Among the Layer 2 networks benefiting from this shift, Base has quickly become a hub of on-chain activity. Users are increasingly drawn to the lower transaction costs while still benefiting from Ethereum’s security and decentralization. This movement underscores how Ethereum is evolving from a single execution layer into a layered ecosystem where scalability and affordability can coexist.

Ethereum’s Fee Revolution Brings Benefits—But Not Without Trade-Offs

The sharp decline in Ethereum’s transaction fees has created a new dynamic within the network—one that brings major benefits for users but introduces long-term questions for the protocol’s sustainability.

For retail users and smaller decentralized finance (DeFi) projects, the reduced cost of interacting with the Ethereum network has opened the door to greater participation. Transactions that were once prohibitively expensive for low-value trades or micro-transactions are now viable, making the ecosystem more accessible than ever. This newfound affordability could significantly broaden Ethereum’s utility in day-to-day finance and emerging sectors like real-world asset (RWA) tokenization.

But the benefits come with growing concerns for validators, who depend on network fees as a core revenue stream. As those fees dwindle, the economic model underpinning Ethereum’s security begins to tilt more heavily toward ETH issuance—raising questions about whether that approach is sustainable in the long run. This shift marks a potential trade-off: lower fees enhance adoption, but may challenge the incentive mechanisms that keep the network secure and decentralized.

Adding to the complexity is Ethereum’s market performance in 2025. Despite leading in network activity, stablecoin transfers, and infrastructure development, ETH has underperformed Bitcoin significantly this year. The decoupling between network usage and token price suggests that Ethereum’s economic success may no longer be directly tied to how often it is used, but how value is captured and redistributed within its evolving architecture.

These developments are crucial for the mainstream adoption of blockchain technologies, as they enhance user experience and reduce barriers to entry.

Quick Facts

- Ethereum’s transaction fees have reached historic lows due to protocol upgrades and Layer 2 adoption.

- The implementation of EIP-4844 has optimized network efficiency, contributing to reduced gas fees.

- Increased use of Layer 2 solutions has alleviated mainnet congestion, further lowering transaction costs.

- DeFi platforms have seen a decline in revenues, correlating with the decrease in transaction fees and on-chain activity.