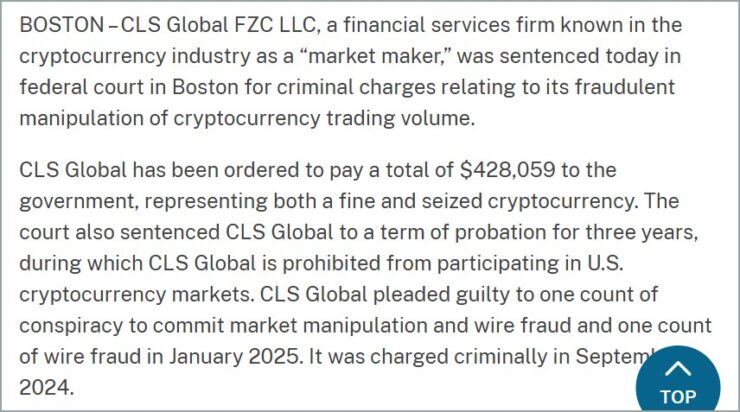

CLS Global, a UAE-based market-making firm, has been hit with a $428,059 penalty after admitting to orchestrating fraudulent trading activities designed to mislead investors.

The sentencing, delivered by a federal court in Boston, includes a mix of fines and crypto asset forfeitures and follows the company’s guilty plea to charges of market manipulation and wire fraud in January.

The court ruling also restricts CLS Global from participating in U.S. cryptocurrency markets for the next three years.

This probation period effectively shuts the firm out of one of the world’s most regulated crypto jurisdictions, sending a clear signal that enforcement agencies are cracking down on deceptive trading tactics.

The case stems from a wider federal investigation into illicit crypto activity, particularly wash trading—an illegal practice where firms trade with themselves to inflate trading volume and attract investor interest falsely.

CLS Global was among the targets of a coordinated sting operation that specifically sought to expose such schemes.

How CLS Global Engineered Fake Market Activity

The case against CLS Global has shed new light on the inner workings of how crypto market manipulation is quietly carried out behind the scenes.

Based in the United Arab Emirates and employing around 50 staff, the firm operated across borders, targeting digital assets accessible to U.S. investors despite being outside U.S. jurisdiction.

According to court records, CLS Global admitted in January 2025 to one count of conspiracy to commit market manipulation and wire fraud, along with a separate wire fraud charge.

Prosecutors revealed that the company deliberately used an automated algorithm to execute self-trades—transactions made between multiple wallets controlled by the same entity—to fabricate trading volume on the blockchain.

“The investigation included the creation of NexFundAI, a purported cryptocurrency company that had a website and an Ethereum-based token that traded on the Uniswap cryptocurrency exchange before being disabled by law enforcement,” the court report states.

“CLS Global agreed to provide market-making services for the NexFundAI token that included ‘wash trading’ to fraudulently attract investors to purchase the token.”

During a series of videoconference calls recorded by investigators, an employee openly discussed the firm’s tactics, admitting the trades were not real and were instead designed to simulate organic demand.

“I know that it’s wash trading, and I know people might not be happy about it,” the employee remarked.

While CLS Global has accepted responsibility, U.S. authorities noted that the case involves additional individuals, including at least one co-defendant who has not yet stood trial. Prosecutors emphasized that the remaining parties are presumed innocent unless proven guilty.

Implications for the Crypto Industry

This case is part of a broader crackdown on fraudulent activities within the cryptocurrency sector. Notably, the FBI’s “Operation Token Mirrors” has led to charges against multiple individuals and firms engaged in similar deceptive practices.

For instance, Aleksei Andriunin, founder of cryptocurrency market maker Gotbit, recently pleaded guilty to market manipulation charges, admitting to orchestrating wash trades to inflate token trading volumes for clients.

These enforcement actions signal a concerted effort by regulatory bodies to ensure transparency and integrity in the rapidly evolving digital asset marketplace.

Quick Facts

- UAE-based CLS Global was fined $428,059 and placed on three years’ probation for market manipulation and wire fraud.

- The firm admitted to using self-trading algorithms to simulate trading activity and mislead investors.

- CLS Global is now barred from participating in U.S. crypto markets during its probation period.

- The case is part of a broader crackdown on wash trading and deceptive practices in the digital asset industry.