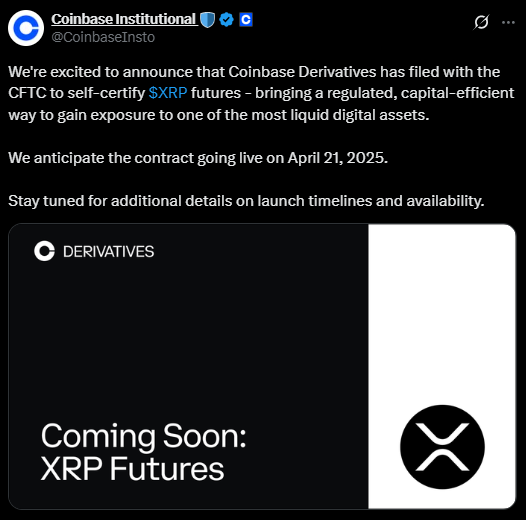

Coinbase Institutional has taken a major step toward expanding its crypto derivatives offerings by filing with the U.S. Commodity Futures Trading Commission (CFTC) to self-certify XRP futures contracts through its affiliate, Coinbase Derivatives. Pending final compliance review, the contracts are expected to launch on April 21, 2025.

The move signals Coinbase’s push to make XRP more accessible in a regulated futures format, providing investors with new tools for hedging, speculation, and market participation—all under the CFTC regulatory framework.

Coinbase’s self-certification method allows it to launch the XRP futures without waiting for explicit CFTC approval—as long as the product complies with the commission’s rules. This process is commonly used for new futures contracts involving crypto or other structured financial instruments.

Adding XRP futures may deepen liquidity and bring greater institutional interest to the asset, particularly as futures allow for capital-efficient exposure to crypto markets. The structured product also expands the suite of tools for managing price volatility and directional bets.

“By launching XRP futures under a compliant framework, Coinbase is positioning itself at the forefront of regulated digital asset markets,” said one industry analyst. “This could be a game-changer for XRP’s institutional adoption.”

Broader Market Momentum for XRP

Coinbase’s futures initiative coincides with a wave of renewed interest in XRP across the broader crypto market. Kraken, one of the largest U.S.-based exchanges, recently listed Ripple USD (RLUSD), a stablecoin tied to the Ripple ecosystem. Before Kraken’s integration, RLUSD had only been available on Bitstamp.

These developments are helping build stronger infrastructure around XRP, expanding its use cases and improving access for investors and developers alike.

As of the time of writing, XRP is approaching key technical levels. Analysts noted that XRP recently tested the 0.382 Fibonacci retracement level, a common resistance zone. Although the price was rejected at that level, traders are now watching the $1.95 and $1.90 support zones.

If XRP manages to hold above $1.90, a bullish reversal may be in play, particularly if paired with a positive divergence in the RSI (Relative Strength Index). On the other hand, a breakdown below $1.90 could lead to deeper corrections.

Coinbase’s XRP futures filing generated a mix of enthusiasm and confusion. In a now-deleted tweet, the exchange initially referred to the product as “Ripple futures,” sparking backlash from the XRP community.

Rising Competition in XRP Derivatives

Coinbase isn’t the only one targeting XRP derivatives. In late March, Bitnomial, a U.S.-based crypto options and futures exchange, also announced its plans to offer XRP futures—a move in the works since October 2024. The growing interest in regulated XRP products reflects a broader trend of institutional players warming to the token as regulatory clarity around it improves.

With both Coinbase and Bitnomial preparing to launch XRP futures, the stage is set for increased market depth, price discovery, and mainstream acceptance of one of crypto’s most widely discussed digital assets.