Two senior Democratic lawmakers are urging the Securities and Exchange Commission (SEC) to preserve and disclose records related to World Liberty Financial (WLFI), a cryptocurrency firm with direct ties to President Donald Trump’s family.

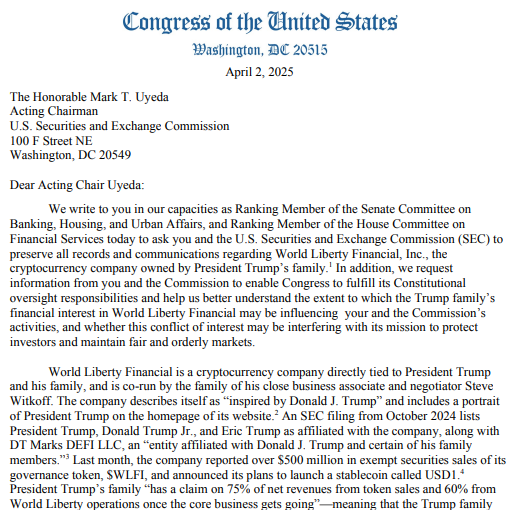

In an April 2 letter, Senator Elizabeth Warren and Representative Maxine Waters, ranking members of the Senate Banking Committee and House Financial Services Committee, respectively—called on acting SEC Chair Mark Uyeda to maintain all records and communications connected to WLFI and the Trump family.

“The Trump family’s financial stake in World Liberty Financial represents an unprecedented conflict of interest,” they wrote.

The letter follows a series of crypto-related moves by Trump and WLFI. Most notably, WLFI launched a USD-pegged stablecoin, USD1, on BNB Chain and Ethereum in late March. Trump has also floated plans for a national cryptocurrency stockpile and has reportedly backed the launch of a TRUMP meme coin—all while holding a financial stake in WLFI.

Warren and Waters argue that these connections raise red flags about impartial regulation and the potential for executive influence over agencies meant to operate independently of the administration.

Call for Oversight, Transparency, and Accountability

The lawmakers asked the SEC to preserve all internal and external communications related to WLFI and the Trump family, including any contact that may have influenced SEC policy or enforcement decisions. They emphasized the need for regulatory independence:

“The American people deserve to know whether their financial markets are being regulated impartially or whether regulatory decisions are being made to benefit the President’s family financial interests.”

Waters echoed these concerns during a House Financial Services Committee hearing on the same day, warning that without oversight, Trump could use WLFI’s stablecoin for government payments, creating a direct profit pipeline from public funds to private family holdings.

Since Trump appointed Mark Uyeda as acting SEC chair, the agency has dropped multiple investigations and enforcement actions against crypto firms—including several whose executives contributed to Trump’s 2024 campaign.

Further questions surround Trump’s preferred nominee to lead the SEC permanently, Paul Atkins. He is expected to face a vote on April 3 in the Senate Banking Committee. If approved, his nomination will move to the full Senate for confirmation.

A Broader Battle Over Crypto and Power

The letter from Warren and Waters highlights a growing political divide over how to handle cryptocurrency, the power of the presidency, and whether public officials should be involved in private business deals.

As Trump becomes more involved in the crypto world, critics say it’s important to set clear rules to avoid corruption or unfair influence.

What the SEC does next and how Congress deals with Trump’s pick to lead the agency, could affect not just the future of crypto rules, but also the larger conversation about honesty, fairness, and who really has power in financial decision-making.