BlackRock, the world’s largest asset manager, has secured approval from the UK Financial Conduct Authority (FCA) to operate as a registered crypto asset firm, marking a significant step in the company’s expanding digital asset strategy.

As shown on the FCA’s register on Tuesday, BlackRock has been granted permission to act as an arranger for iShares Digital Assets AG, the entity responsible for issuing crypto-based exchange-traded products (ETPs) under the company’s iShares brand.

With this registration, BlackRock is authorized to “arrange the execution of transactions in cryptoassets” to facilitate subscriptions and redemptions of crypto-backed ETPs between issuers and authorized participants.

However, the approval comes with certain restrictions:

- BlackRock is not permitted to onboard new retail customers under this registration.

- The firm is also prohibited from operating automated systems or machines that exchange crypto for fiat or vice versa, unless it obtains written consent from the FCA.

Joining an Elite Group on the FCA Crypto Register

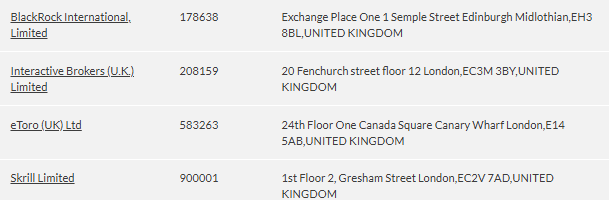

BlackRock’s registration places it among a select group of firms approved to operate within the UK’s stringent crypto regulatory framework. Since the crypto register’s inception in 2020, the FCA has received 368 applications, but has approved just 51 firms.

The register was designed to ensure that crypto businesses serving UK customers comply with the country’s anti-money laundering (AML) and counter-terrorism financing regulations.

Gaining a spot on the FCA’s crypto register is “not an easy feat,” reflecting BlackRock’s efforts to align with one of the world’s most rigorous crypto compliance regimes.

Other recent additions to the register include Coinbase, which also received approval this year ahead of broader regulatory changes on the horizon.

A Strategic Move Amid a Changing Regulatory Landscape

BlackRock’s approval comes as the UK prepares to roll out a new crypto regulatory framework, which is expected to tighten oversight of digital asset service providers and enhance consumer protection measures.

While BlackRock has already made waves in the U.S. through its spot Bitcoin ETF, this move signals growing momentum in Europe as the asset manager continues to bridge traditional finance with digital assets.

The FCA approval could pave the way for more regulated crypto investment vehicles in the UK market, particularly as demand for regulated, institutionally backed crypto products grows.