Japanese investment firm Metaplanet has acquired an additional 696 bitcoins, expanding its total holdings to 4,046 BTC, according to a disclosure made Tuesday alongside its Q1 earnings report. The purchase, valued at ¥10.15 billion ($67.9 million), was executed through the settlement of previously sold cash-secured put options.

The derivative-based acquisition was structured earlier in the quarter—when Bitcoin was trading near all-time highs above $100,000—and ultimately yielded an average nominal purchase price of $97,512 per BTC. However, after factoring in premium income earned from the contracts, Metaplanet’s effective acquisition cost came to $86,500.57 per BTC, well below prevailing spot rates at the time of purchase.

In its statement, Metaplanet described the strategy as capital-efficient, noting it enabled the firm to acquire more BTC per yen deployed while simultaneously generating additional revenue. The move reflects a refined approach to Bitcoin exposure, balancing long-term accumulation with yield-oriented derivatives strategies.

Metaplanet Optimizes Bitcoin Exposure Through Options-Based Accumulation

Rather than purchasing Bitcoin directly on the spot market, Metaplanet’s acquisition was executed via a structured derivatives approach centered on cash-secured put options. This strategy allowed the Tokyo-listed firm to lock in potential future purchases at predetermined prices while earning income from option premiums.

In a typical cash-secured put strategy, the seller commits to buying an asset—Bitcoin, in this case—at a strike price if the market declines below that level. If exercised, the seller must purchase the asset, but retains the premium received. For Metaplanet, that scenario played out in Q1, as Bitcoin retreated from record highs to trade near $84,214 at the time of settlement.

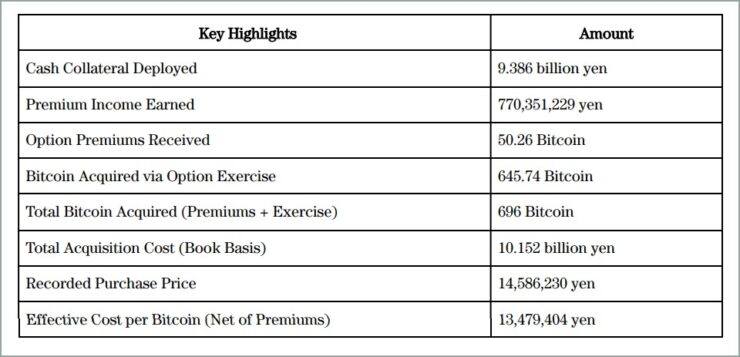

Despite the decline in BTC price, Metaplanet emphasized that the options framework provided a cost-effective acquisition method. The firm deployed approximately ¥9.386 billion ($62.7 million) in collateral and earned ¥770.3 million ($5.2 million) in premium income. This lowered the net effective cost to ¥13.48 million (approximately $90,073) per BTC. While the book cost remained at $97,512, the actual capital outlay was reduced through the income generated.

The firm described the transaction as a strategic use of volatility, allowing it to accumulate Bitcoin at favorable terms while avoiding full exposure at peak market levels.

Metaplanet Sets Aggressive Accumulation Target, Joins Top 10 Corporate Bitcoin Holders

Metaplanet’s latest acquisition is part of an ambitious strategy initiated in April 2024, which targets 10,000 BTC by the end of 2025, with a long-term goal of 21,000 BTC by 2026. With 4,046 BTC now held in reserve—valued at approximately $340 million—the firm has entered the top 10 publicly known corporate holders of Bitcoin.

Just last week, Metaplanet disclosed a 150 BTC purchase for $12.6 million, at an average price of $83,801 per coin. That move coincided with the firm’s appointment of Eric Trump to its Strategic Board of Advisors, a development that has drawn attention across both financial and political spheres.

On Monday, Metaplanet further announced the issuance of ¥2 billion (about $13.3 million) in zero-interest bonds, earmarked for additional Bitcoin purchases. The funding was approved by the company’s board, reinforcing its commitment to aggressive BTC accumulation despite recent market volatility.

With its current holdings, Metaplanet now stands alongside major institutional players such as MicroStrategy, Tesla, Block, and Marathon Digital. According to Bitcoin Treasuries, Metaplanet ranks ninth globally among corporate holders of BTC—marking a significant ascent for the firm in the digital asset space.

Quick Facts

- Metaplanet acquired 696 BTC via cash-secured put options, bringing total holdings to 4,046 BTC.

- The firm spent $67.9 million at a nominal average price of $97,512, with an effective cost of $86,500 after premiums.

- The options strategy generated $5.2 million in income, enhancing capital efficiency.

- Metaplanet now ranks among the top 10 public corporate Bitcoin holders, joining companies like MicroStrategy, Tesla, and Block.