Kentucky has dropped its lawsuit against Coinbase over its staking services, becoming the third state in recent weeks to reverse course. The move comes less than a week after Governor Andy Beshear signed House Bill 701 into law, a sweeping measure that affirms the legality of crypto self-custody and shields staking and mining from securities oversight.

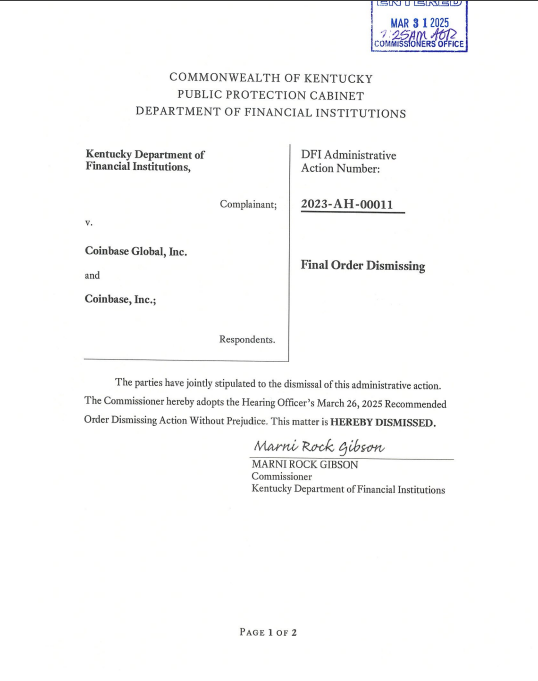

The Kentucky Department of Financial Institutions filed a joint stipulation of dismissal on Monday. Its lawsuit, part of a broader multistate enforcement effort launched in June 2023, alleged that Coinbase had violated securities laws by offering unregistered staking services. The program allowed users to delegate tokens in proof-of-stake networks, which regulators argued constituted an unlicensed investment offering.

The case’s dismissal follows similar actions by South Carolina and Vermont. Vermont exited the joint enforcement effort on March 14, citing the dismissal of a federal lawsuit and prospects for more consistent national regulation. Days later, South Carolina withdrew its own suit. Coinbase Chief Legal Officer Paul Grewal said South Carolina residents lost an estimated $2 million in rewards during the staking ban.

Grewal welcomed the reversals. “Kentucky’s dismissal of its case against Coinbase, in rapid succession after Vermont and South Carolina, is a win for customers, innovation, and economic opportunity,” he told Decrypt. In a separate post on X, he urged Congress to adopt a federal market structure law: “Congress needs to end this litigation-driven, state-by-state approach with a federal market structure law ASAP.”

Legislation and Regulatory Realignment

Kentucky’s reversal comes as part of a broader trend in crypto policy among state and federal regulators. HB701, signed into law by Gov. Beshear, affirms the legality of self-custody of digital assets. The bill also exempts staking rewards from state money transmitter rules and protects blockchain node operators from securities oversight. It passed both legislative chambers unanimously.

The original multistate enforcement push included Alabama, California, Illinois, Kentucky, Maryland, New Jersey, South Carolina, Vermont, Washington, Wisconsin, and Alabama. The effort began the same day the SEC filed a lawsuit against Coinbase in June 2023.

The SEC’s position has since shifted. In February, the agency dropped its lawsuit against Coinbase. Acting SEC Chair Mark Uyeda has adopted a more conciliatory stance, contributing to the wave of state-level dismissals.

Seven states—California, New Jersey, Illinois, Washington, Alabama, Maryland, and Wisconsin—continue to pursue enforcement actions against Coinbase.