The Trump family has officially taken majority control of World Liberty Financial, a decentralized finance platform currently in its pre-launch phase. The consolidation was formalized in January through the formation of WLF Holdco LLC, a parent company established to oversee the platform’s development and governance. According to legal disclosures on the World Liberty Financial website, 60% of WLF Holdco is owned by DT Marks DeFi LLC, an entity directly linked to Donald J. Trump and multiple members of his family.

The move represents a significant leadership shift. As reported by Reuters, the platform’s original co-founders, Zak Folkman and Chase Herro, have been removed as sole directors and controlling members of World Liberty Financial Inc. Their roles were dissolved under the new corporate structure, transferring executive control to the Trump family’s holding company.

While the remaining 40% ownership of WLF Holdco has not been publicly disclosed, the Trump family now wields considerable influence over both protocol development and governance. Legal documents confirm that DT Marks DeFi and its affiliates collectively hold at least 22.5 billion WLFI tokens, more than 20% of the platform’s total 100 billion token supply.

Leadership and Governance Structure

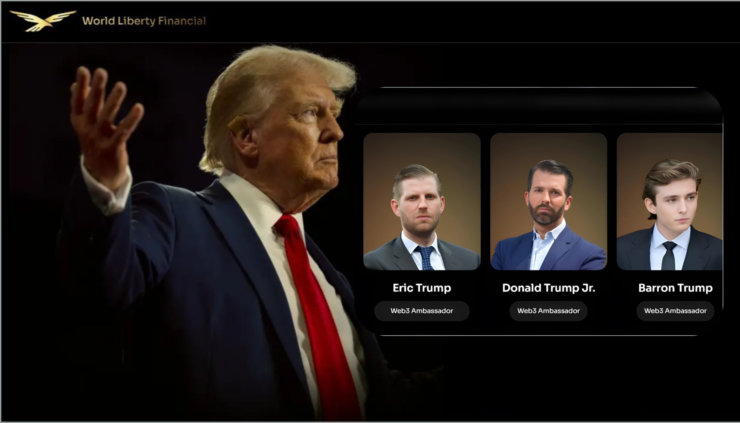

From inception, World Liberty Financial positioned members of the Trump family in prominent leadership roles as part of its public branding strategy. Donald Trump serves as “Chief Crypto Advocate,” while his sons Eric Trump and Donald Trump Jr. are titled “Web3 Ambassadors.” Barron Trump, the youngest, is listed as the project’s “Chief DeFi Visionary.”

Outside of the Trump family, the early leadership team included Zach Witkoff, son of former U.S. Middle East envoy Steven Witkoff, and Rich Teo, co-founder of blockchain infrastructure firm Paxos. Both were initially named as co-founders, but legal filings indicate a change in their roles under the new governance model.

Eric Trump, now a board member of WLF Holdco LLC, has emerged as the leading decision-maker in the organization. His role positions him at the center of the platform’s strategic roadmap and long-term protocol management.

Financially, the Trump family’s involvement is far from symbolic. Under current arrangements, DT Marks DeFi LLC is entitled to 75% of net revenues from WLFI token sales and 60% of future operational profits once core features—such as crypto lending and personal finance tools—are launched. Based on data shared with Reuters, this equates to roughly $400 million of the $550 million raised to date, with more potential upside in future token offerings.

Revenue Accumulation and Financial Implications

World Liberty Financial’s consolidation under Trump leadership followed a second major funding event in January, which raised $250 million through an additional WLFI token sale. This round released another 5% of the platform’s total token supply—on the heels of the original 20 billion token offering that sold out ahead of Inauguration Day.

On-chain analysis shows that over 85,000 wallets have participated in WLFI token purchases. However, a significant share of capital came from large investors: 70% of funds were contributed by wallets spending over $100,000, and more than half of that came from buyers who committed $1 million or more. Among the most high-profile participants is Tron founder Justin Sun, who acquired $75 million worth of WLFI tokens.

Despite strong fundraising, the project’s treasury has faced volatility. While cycling through a wide range of assets—including ETH, WBTC, USDT, and USDC—the treasury once held over $360 million in digital assets before a rapid liquidation event wiped out more than 90% of its balance. Since then, accumulation has resumed, with current wallet balances reflecting over $80 million in crypto holdings.

The Trump family’s majority stake in WLFi marks a notable development in the intersection of politics, finance, and blockchain technology. With significant control over governance, token supply, and future revenue streams, their involvement positions the project as a high-profile case study within the DeFi sector. As the platform advances toward launch, observers will be closely watching how its centralized leadership structure aligns with the decentralized ethos it promotes—and whether this hybrid approach can deliver both credibility and scalability in an increasingly competitive market.

Quick Facts:

- The Trump family now owns a 60% stake in World Liberty Financial through DT Marks DeFi LLC.

- They are entitled to approximately $400 million in proceeds from the platform’s $550 million in token sales.

- Donald Trump is listed as Chief Crypto Advocate, Eric and Donald Jr. as Web3 Ambassadors, and Barron Trump as Chief DeFi Visionary.

- The platform’s centralized governance structure has drawn criticism from parts of the DeFi community.