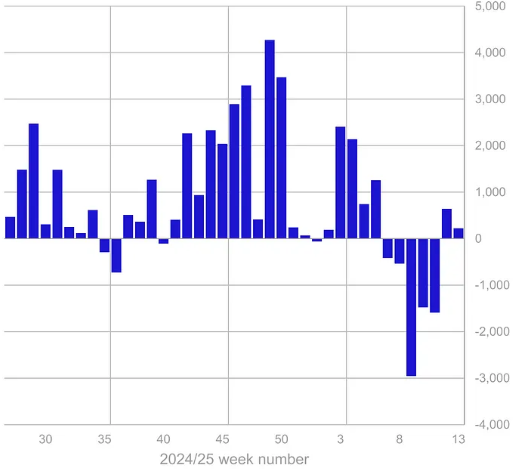

Cryptocurrency exchange-traded products (ETPs) pulled in $226 million in fresh capital last week, signaling a potential shift in investor sentiment despite broader market turbulence. The inflows mark a strong rebound following a weeks-long streak of outflows and renewed interest in digital asset funds.

According to a March 31 report from CoinShares, global crypto ETPs recorded $226 million in net inflows during the most recent trading week. This comes on the heels of the previous week’s $644 million in inflows, helping reverse a five-week trend that had rattled investor confidence.

However, this renewed capital interest hasn’t translated into overall market growth. Total assets under management (AUM) continued to slide, falling below $134 billion by March 28, down from $142 billion on March 10. The decline reflects ongoing weakness in underlying asset prices and broader macroeconomic pressure.

CoinShares’ head of research James Butterfill described the inflows as evidence of “cautious optimism” returning to the crypto sector. The timing aligns with a higher-than-expected U.S. core Personal Consumption Expenditures (PCE) report, a key inflation indicator that often shapes investor expectations on interest rates and economic policy.

This suggests that despite a challenging macro backdrop, institutional investors still see long-term value in digital assets, particularly during periods of price correction.

Bitcoin Reclaims Market Attention, Shorts Decline

As usual, Bitcoin (BTC) dominated inflows, accounting for $195 million, or roughly 86% of the weekly total. This reinforces Bitcoin’s position as the gateway for institutional crypto exposure, especially during periods of elevated risk.

Meanwhile, short-Bitcoin investment products, which profit from price declines—saw $2.5 million in outflows for the fourth straight week. This continued unwinding of bearish positions may suggest that traders expect a stabilization or rebound in BTC’s price.

Notably, Bitcoin ETP AUM dropped to $114 billion, the lowest level since just after the U.S. presidential election, underscoring how recent price movements have heavily impacted overall portfolio valuations.

After a brutal month of outflows totaling $1.7 billion, altcoins finally saw modest signs of recovery with $33 million in inflows.

Leading the altcoin rebound:

- Ethereum (ETH): $14.5 million

- Solana (SOL): $7.8 million

- XRP: $4.8 million

- Sui (SUI): $4 million

Although these numbers remain small compared to Bitcoin, they signal a renewed appetite for diversified exposure in crypto portfolios, especially in assets with strong ecosystems and developer traction.

Ethereum’s return to inflow territory is particularly notable, as it often serves as a barometer for broader DeFi and smart contract market sentiment.

Performance vs. Participation: A Widening Gap

The disconnect between inflows and falling AUM highlights a critical trend: investor participation is rising, but performance is lagging. Since January 1:

- Bitcoin is down 13.6%

- The total crypto market cap has dropped nearly 20%, according to CoinGecko

This dynamic suggests investors may be buying the dip, but price stability and stronger fundamentals are still needed to regain broader momentum.

The Takeaway

The past two weeks of inflows signal that institutional capital is quietly re-entering the crypto market, even as overall valuations remain under pressure.

While inflows offer a much-needed sentiment boost, they don’t yet represent a full trend reversal. Investors are clearly dipping their toes back in, but not diving headfirst.

To sustain growth, the market will need more than short-term relief. It will require macroeconomic clarity, stronger asset fundamentals, and continued institutional engagement.