Bitcoin is heading for its worst first-quarter performance in seven years, falling 11.86% in Q1 2025, according to CoinGlass data. The decline comes as investor sentiment weakens and outflows from U.S.-based spot Bitcoin ETFs mount, ending a 10-day inflow streak.

Selling pressure pushed Bitcoin below $85,000, triggering nearly $90.56 million in liquidations over the past 24 hours. Long traders bore the brunt of the losses, with $79.3 million wiped out, while short sellers lost $11.25 million. Bitcoin’s open interest dropped 4.5%, nearing $54 billion, indicating waning market participation. The long/short ratio stands at 0.6051, with 62.3% of traders betting on further downside.

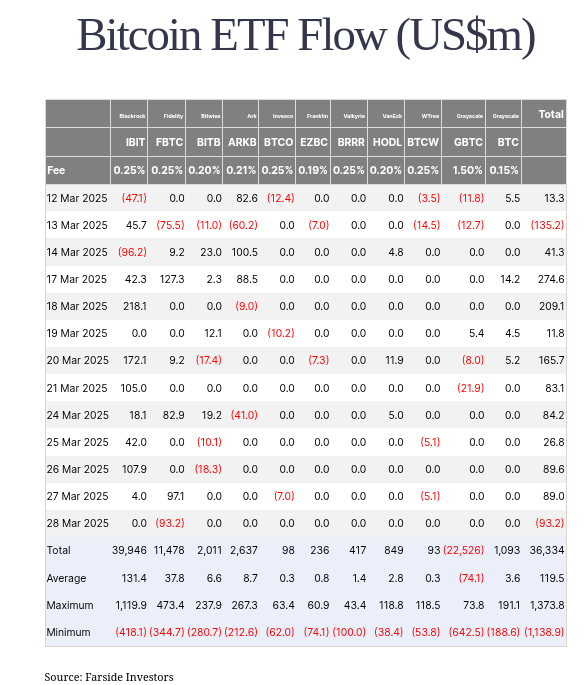

ETF flows reflect the pullback. Fidelity’s FBTC led outflows on Friday, losing $93.16 million just a day after gaining $97.14 million. Most other funds posted minimal changes. The total trading volume across U.S.

Bitcoin ETFs edged higher to $2.22 billion. Despite the modest uptick, Presto Research analyst Min Jung cautioned that investors are showing little risk appetite. “Institutional demand remains,” Jung said, “but it’s not aggressive.”

ETF Activity Highlights Diverging Institutional Strategies

Grayscale’s GBTC fund, which has the highest management fee at 1.50%, remains a consistent source of outflows, according to daily flow data from Farside. Over the observed period, GBTC saw outflows totaling $22.53 billion.

By contrast, BlackRock’s IBIT fund posted inflows of $39.95 billion, followed by Fidelity’s FBTC at $11.48 billion. Total net inflows across all tracked Bitcoin ETFs stood at $36.33 billion.

Bitcoin’s Q1 decline surpasses the 10.83% loss in the first quarter of 2020, making it the weakest start to a year since 2018, when it dropped 49.7%. Continued selling could drive the price below $80,000, especially with mounting macroeconomic pressures.

The recent downturn erased almost all of Bitcoin’s weekly gains, with investors closely watching the upcoming U.S. tariffs expected to take effect on April 2. Stronger-than-expected core PCE data has added to uncertainty.

Ethereum ETFs, in contrast, posted a rare net inflow day on Friday. Grayscale’s ETHE brought in $4.68 million, breaking a 17-day outflow streak. Other Ethereum funds remained flat.

The combined value of U.S. spot Ethereum ETFs stands at $6.42 billion—far below the $94.39 billion managed by Bitcoin ETFs. Grayscale’s ETHE leads with $2.28 billion in assets, narrowly ahead of BlackRock’s ETHA at $2.24 billion.

With macroeconomic concerns intensifying and risk appetite weakening, analysts are watching closely to see whether Bitcoin can stabilize before the next earnings cycle and regulatory developments in April. Trading desks are now assessing whether the recent ETF inflow streak was a temporary rebound or the beginning of a deeper structural shift in institutional positioning.