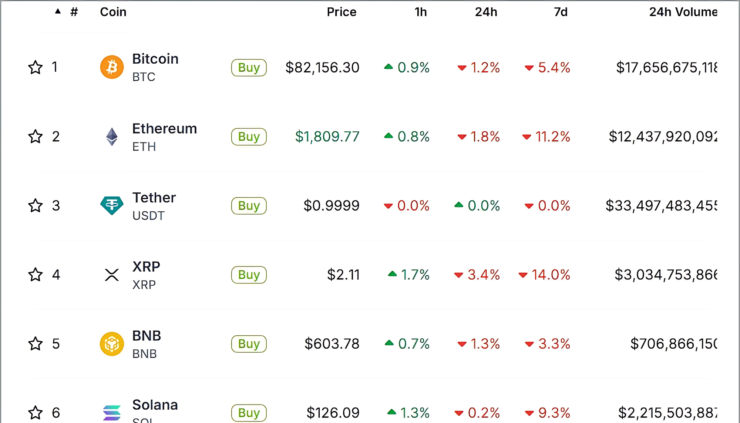

Cryptocurrency markets opened the week on a cautious note, mirroring the jittery mood in traditional finance as investors prepare for a potentially volatile stretch driven by trade policy announcements and inflationary signals. Bitcoin dipped below $82,200 on Sunday evening, dragged down by the growing unease around new tariffs and their potential impact on global markets.

Ethereum followed suit, trading just under $1,810, while XRP slid further to approximately $2.11, according to CoinGecko data. The broader digital asset market echoed the sentiment, shedding gains accumulated earlier in the month as momentum cooled across both tech and crypto sectors.

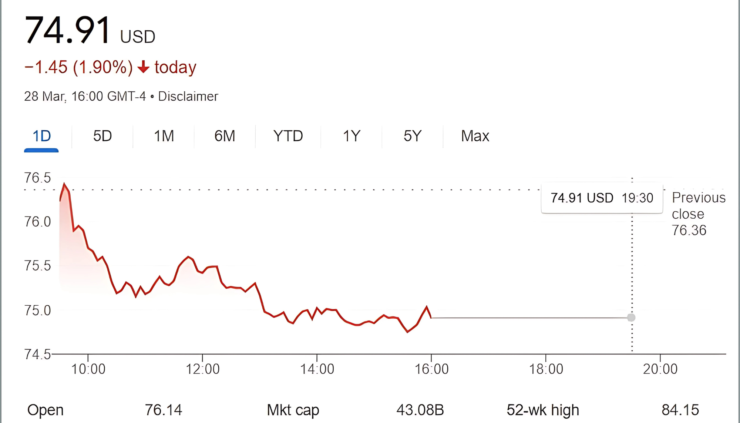

The selloff wasn’t limited to crypto. Futures tied to the S&P 500, Nasdaq-100, and Dow Jones all registered early declines in the range of 0.5% to 0.8%, a reflection of mounting concerns about inflationary pressures and tightening fiscal policies. With a financial calendar packed with major economic updates—including inflation readings and potential policy shifts—investors across asset classes appear to be repositioning in anticipation of heightened volatility.

Tariff Shockwaves Stir Investor Anxiety Across Risk Assets

Investor unease deepened over the weekend as markets began pricing in the global ripple effects of a sweeping tariff initiative set to take effect on April 2. Spearheaded by President Donald Trump, the upcoming measure targets a broad spectrum of imports—most notably in the auto, pharmaceutical, and semiconductor sectors—impacting trade flows with over two dozen countries, according to analysis from Barclays.

The tariff campaign is part of a controversial plan to generate $600 billion annually via a proposed import taxation system unofficially dubbed the “External Revenue Service.” Industry observers warn that aggressive trade maneuvers could reignite inflationary pressures and weigh heavily on global supply chains.

While cryptocurrencies are not directly tied to the trade of physical goods, the knock-on effect of macroeconomic shifts tends to spill over into all risk-sensitive assets. The prospect of disrupted international commerce and rising prices has pushed investors toward a more defensive stance, prompting sharp sell-offs in both digital and traditional financial markets.

Consumer Confidence Falters as Inflation Fears Gain Ground

The growing wave of economic uncertainty is beginning to take its toll on American consumers. Recent financial insights reveal that confidence among U.S. households has plunged to levels typically seen only during recessions, signaling that the broader economy may already be entering a slowdown. A sharp 20-point drop in sentiment over the past month has raised alarms among analysts who interpret the downturn as a clear sign that economic pressures are beginning to bite.

In theory, assets like Bitcoin have often been touted as potential safe havens during inflationary periods. However, current market behavior tells a different story. As crypto assets continue to move in tandem with equities, their perceived role as an inflation hedge remains under scrutiny. For now, both traditional and digital markets appear increasingly vulnerable to the same macroeconomic forces—tightening policy, rising prices, and fading consumer optimism.

Quick Facts:

- Bitcoin’s price dropped below $82,200 amid rising trade tensions and inflation fears.

- Ethereum and XRP also experienced significant declines, trading at approximately $1,810 and $2.11, respectively.

- The U.S. administration’s proposed 25% tariffs on automotive imports have contributed to investor anxiety and market volatility.

- Stocks outside of crypto markets, including those in the S&P 500, Nasdaq-100, and Dow Jones, saw notable declines, reflecting broader market apprehensions.