Uniswap’s mobile app has seen a substantial decline in visibility on the U.S. App Store over the past two months, dropping from a high of 99th place in the finance category to 364th, according to app analytics data. The dip follows a brief surge in downloads and user activity fueled by pro-crypto policy momentum around President Donald Trump’s inauguration in January.

Throughout most of 2024, Uniswap maintained an average ranking around the 190s. However, after Trump’s election victory in November, the app saw a noticeable rise, climbing into the low 110s and eventually peaking at 99 during inauguration week. That uptick appeared to coincide with heightened interest in crypto and decentralized finance (DeFi) applications, fueled by market optimism and regulatory shifts under the new administration.

Since then, the platform’s App Store ranking has fallen consistently, now sitting well below its average levels from the previous year. The data suggests that Uniswap’s improved visibility during the election period was temporary and closely tied to broader political enthusiasm rather than sustained user growth.

On-Chain Metrics Paint a Bleak Picture for Uniswap’s User Engagement

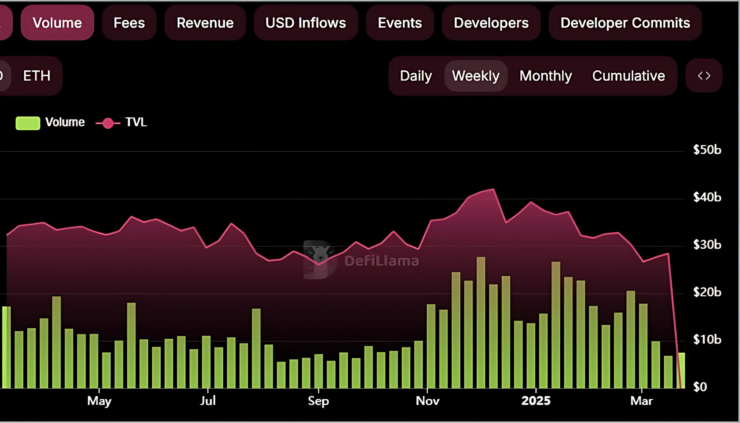

The recent plunge in Uniswap’s App Store ranking is mirrored by on-chain metrics, where platform usage has contracted sharply since the start of the year. According to blockchain data, the number of active traders on Uniswap’s Ethereum deployment has dropped by more than 45% since January, falling from nearly 70,000 to approximately 37,000—a level not recorded since mid-2023.

Trading volume has also followed a downward trajectory. Between December 2024 and January 2025, Uniswap saw a 10% decline in monthly volume, followed by a steeper 22% contraction in February. Preliminary figures for March suggest volumes remain well below previous months, indicating the downturn may continue into the second quarter.

This trend underscores broader concerns about declining retail engagement in decentralized finance. While Uniswap remains one of the leading decentralized exchanges by market share, recent data reflects an increasingly cautious trading environment as macroeconomic uncertainty and market fatigue weigh on activity.

Broader Industry Trends Impacting Decentralized Exchanges

Uniswap’s challenges are indicative of a wider trend affecting decentralized exchanges (DEXs). While total 24-hour trading volume across DEXs stands at approximately $7.47 billion, platforms like PancakeSwap and Uniswap have experienced volume decreases of 26.37% and 4.53%, respectively. In contrast, newer exchanges such as PumpSwap have reported significant volume increases, highlighting a shift in user preferences within the DeFi ecosystem.

The downturn in Uniswap’s performance could be attributed to several factors, including market saturation, increased competition from emerging platforms, and a general cooling in the cryptocurrency market. As the DeFi landscape continues to evolve, established platforms like Uniswap may need to innovate and adapt to maintain their market position and user base.

Quick Facts:

- Uniswap’s U.S. App Store ranking fell from 99th to 364th in two months.

- User activity on Uniswap’s Ethereum network dropped by over 45% since January 2025.

- Uniswap’s monthly trading volume declined by 10% from December 2024 to January 2025, with an additional 22% decrease the following month.

- The total 24-hour trading volume across decentralized exchanges is approximately $7.47 billion, with platforms like PancakeSwap and Uniswap experiencing volume decreases.