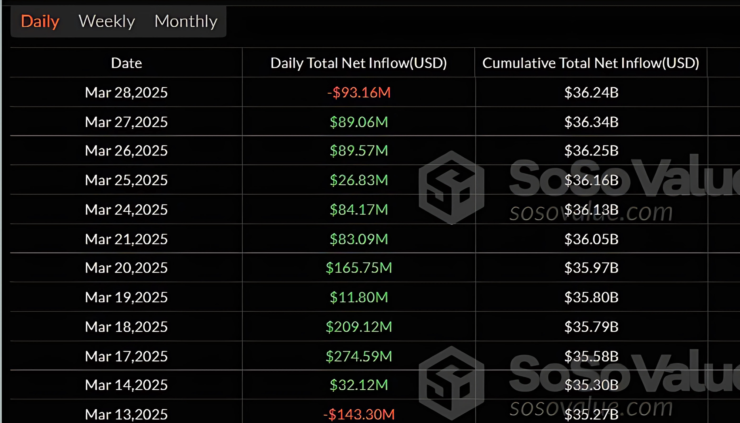

The ten-day streak of uninterrupted inflows into U.S. spot Bitcoin exchange-traded funds came to an abrupt halt on Friday, as investor momentum cooled and market sentiment wavered ahead of the quarter’s end.

Data from SoSoValue shows that Fidelity’s FBTC fund posted a net outflow of $93 million, marking the end of what had been the longest ETF inflow run of the year. This withdrawal comes just one day after the same fund registered over $97 million in fresh inflows, underscoring a sharp shift in investor behavior within a 24-hour window. Other spot Bitcoin ETFs, including BlackRock’s IBIT and Grayscale’s GBTC, registered flat to marginal net flows, reflecting broader indecision in the market.

The pullback coincided with rising volatility in Bitcoin’s price action. BTC has fallen nearly 12% in Q1, currently trading around $83,000—putting it on track for its worst first-quarter close since 2018, when the cryptocurrency plunged nearly 50% during the post-bull market collapse. Although a modest rebound could still push Q1 2025 performance above the 10.8% loss recorded in 2020, the momentum from earlier in the year has clearly stalled.

Despite Friday’s net ETF outflows, total trading volume across all Bitcoin ETF products remained robust, with over $2.2 billion in aggregate turnover.

Ethereum ETFs See Modest Rebound After Prolonged Slump

While spot Bitcoin ETFs snapped their inflow streak, U.S.-based Ethereum ETFs quietly notched a rare positive day—breaking a 17-day stretch of consecutive outflows. According to SoSoValue, Grayscale’s ETHE was the only Ethereum fund to record activity on Friday, bringing in $4.68 million in net inflows.

Despite the modest inflow, the reversal signals a notable shift for Ethereum-based investment products, which have struggled to gain sustained traction since launching. As of now, Grayscale’s ETHE still leads the pack with $2.28 billion in assets under management, narrowly ahead of BlackRock’s ETHA, which holds $2.24 billion. In total, Ethereum ETFs have amassed $6.42 billion in AUM—still a fraction compared to the $94.39 billion held across spot Bitcoin ETFs.

The mild resurgence comes at a critical time for Ethereum’s network. The upcoming Pectra upgrade, scheduled for late April or early May, passed a key milestone this week with a successful rollout on the Hoodi testnet. However, this technical progress has not yet translated into price momentum: ETH fell 2.5% over the past 24 hours, tracking broader altcoin weakness and mirroring Bitcoin’s recent correction.

Investor Appetite Cools Amid Rising Volatility

The inflow streak had fueled hopes of sustained institutional accumulation, especially as funds like BlackRock’s IBIT continued to dominate the ETF landscape. However, the latest sell-off, which erased over $100 billion from the broader crypto market this week, appears to have dampened risk appetite.

The reversal also coincides with macroeconomic concerns, including persistent inflationary pressures and renewed fears of stagflation in the U.S., following February’s Personal Consumption Expenditures (PCE) report. As investors digest economic data and await regulatory signals, capital is being reallocated—at least temporarily—away from high-beta crypto assets.

Beyond Bitcoin, trading volume across centralized exchanges has dropped nearly 70% from post-election highs, signaling a broader market cooldown. Still, long-term sentiment around ETF products remains optimistic. Some analysts suggest that any near-term weakness could present re-entry points for institutional buyers once macro clarity improves.

Quick Facts:

- Spot Bitcoin ETFs recorded a $93 million outflow on Thursday, ending a 10-day inflow streak.

- Bitcoin is on track for its weakest Q1 close since 2018, hovering around $83,000.

- Economic data and macro fears continue to weigh on investor sentiment and crypto inflows.

- Ethereum ETFs notched a rare positive day on Friday, breaking a 17-day stretch of consecutive outflows.