When a crypto exchange dips its toe into altcoin waters, it’s not just listing a token, it’s signing up for an endless race, says River Financial CEO Alex Leishman.

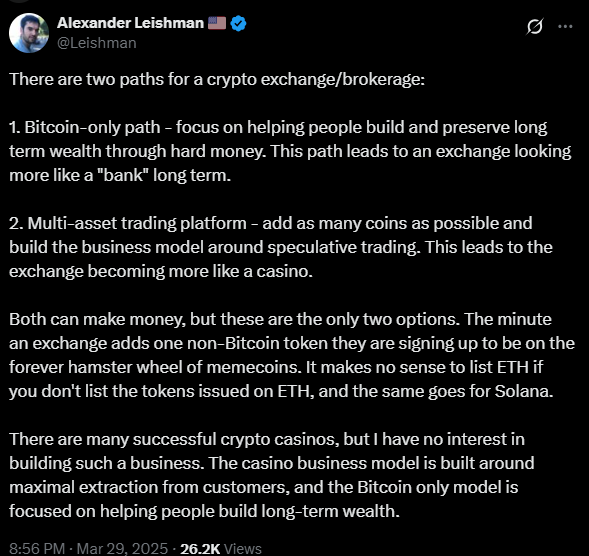

In a pointed March 29 post on X, Leishman warned that listing even a single altcoin initiates a perpetual cycle, where exchanges feel pressured to continuously launch memecoins to maintain user interest and boost trading activity.

“The minute an exchange adds one non-Bitcoin token, they are signing up to be on the forever hamster wheel of memecoins,” he wrote.

River Financial, a Bitcoin-only financial platform, stands firmly against that model. While multi-asset exchanges chase high trading volumes through token variety, Leishman says River’s approach is focused on helping users build long-term value, not speculate on volatile trends.

“The casino business model is built around maximal extraction from customers, and the Bitcoin only model is focused on helping people build long-term wealth.” Leishman stated.

River joins a small but principled group of Bitcoin-focused platforms, including Swan Bitcoin, Bull Bitcoin, and the decentralized exchange Bisq, that reject the altcoin trend in favor of ideological consistency and perceived financial soundness.

Memecoin Craze vs. Crypto’s Core Vision

Critics of the altcoin-fueled exchange model have raised concerns about dilution of purpose and increased risk. In April 2024, A16z CTO Eddy Lazzarin cautioned that the memecoin mania undermines crypto’s original ethos.

Indeed, the memecoin frenzy that dominated headlines in early 2024 has seen a sharp pullback. According to CoinMarketCap, the overall memecoin market cap has fallen nearly 49% since January 1, now sitting around $48.49 billion.

Despite volatility, altcoin listings have proven extremely profitable for exchanges. Platforms like Binance and Robinhood have leaned into the trend, often with impressive returns.

In Q4 2024, Robinhood reported a 700% year-over-year surge in crypto revenue, driven in part by user appetite for speculative trading.

Exchanges also benefit from the perception that listings equal legitimacy. According to onchain analyst Ai_9684xtpa, 12 of 15 memecoins listed on Binance in 2024 saw significant price spikes post-listing—suggesting that exchange exposure is still a powerful driver of price action.

The Future

While River is taking a stand, the broader market may be heading toward consolidation. CoinGecko co-founder Bobby Ong recently predicted that memecoins could follow a “power law” model, where the vast majority collapse while a few dominant tokens survive.

“We may see 99.99% of memecoins fail,” Ong speculated. “Only a handful will rise to the top and endure.”

Whether more platforms adopt River’s Bitcoin-only discipline or continue chasing trading spikes through memecoins, one thing is clear: exchanges that list altcoins are no longer just marketplaces—they’re playing the role of entertainers in an attention economy.