Democratic U.S. Senators are calling on financial regulators to investigate USD1, a Trump-backed stablecoin, over concerns of conflicts of interest and broader financial risks.

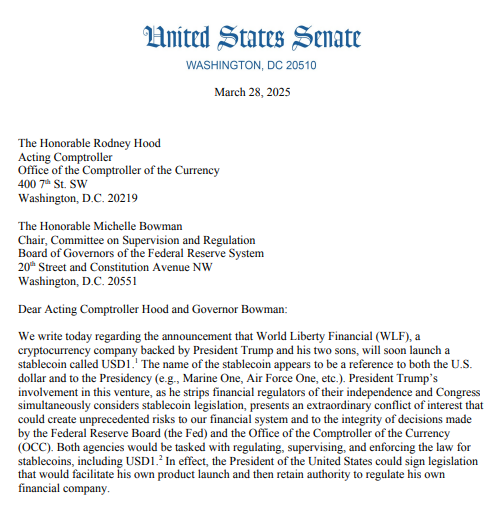

In a letter dated March 28, Senator Elizabeth Warren and four other Democratic members of the Senate Banking Committee urged oversight from the Federal Reserve and the Office of the Comptroller of the Currency (OCC) over World Liberty Financial (WLFI) and its USD1 stablecoin. The project is reportedly backed by President Donald Trump’s family, who hold a 60% equity stake in the crypto firm.

The senators directed their concerns to Fed Governor Michelle Bowman and Acting Comptroller Rodney Hood, asking how the two agencies plan to regulate WLFI and address the “extraordinary” risks posed by a financial product directly tied to a sitting U.S. president.

“The launch of a stablecoin directly tied to a sitting President who stands to benefit financially from the stablecoin’s success presents unprecedented risks to our financial system..”

WLFI’s Stablecoin Launch Sparks Debate

WLFI launched in September 2024, just months ahead of the U.S. presidential election. Despite its high-profile backers, the project has remained opaque, with few public disclosures about its structure or compliance practices. Its flagship stablecoin, USD1, claims to offer a politically neutral digital dollar, but the direct financial stake of the Trump family has drawn intense scrutiny.

The controversy deepened after Trump signed an executive order in February 2025, mandating that all federal agencies “regularly consult and coordinate” policy with White House officials—raising fears of political interference in financial regulation.

The letter comes as Congress weighs the GENIUS Act — a stablecoin regulation bill that would grant the Fed and OCC formal authority to oversee digital dollar issuers. If passed, the legislation could legitimize USD1 under a federal framework—unless potential conflicts of interest are resolved.

“President Trump’s involvement in this venture, as he strips financial regulators of their independence… presents an extraordinary conflict of interest,” the letter stated.

The WLFI controversy arrives at a moment when crypto is becoming deeply entangled with U.S. politics, as stablecoins inch closer to mainstream adoption and federal oversight. While stablecoins like USDC and USDT operate under private-sector stewardship, USD1’s backing by a presidential family blurs the line between state and market.

Democratic lawmakers have called on regulators to act swiftly before USD1 gains further traction in the market—potentially under the shield of executive privilege.

Final Thoughts

With the Federal Reserve’s independence under question, and WLFI’s political affiliations drawing fire, the fate of USD1 could become a defining case study in how the U.S. balances digital innovation with democratic accountability.

As the GENIUS Act progresses and the 2025 election year unfolds, all eyes are on how regulators will respond—and whether crypto can truly remain decentralized in a politically centralized world.