Renowned financial educator Robert Kiyosaki, author of the best-selling book Rich Dad, Poor Dad, has once again stirred the investment world, this time by touting silver as the best short-term asset, ahead of even Bitcoin and gold.

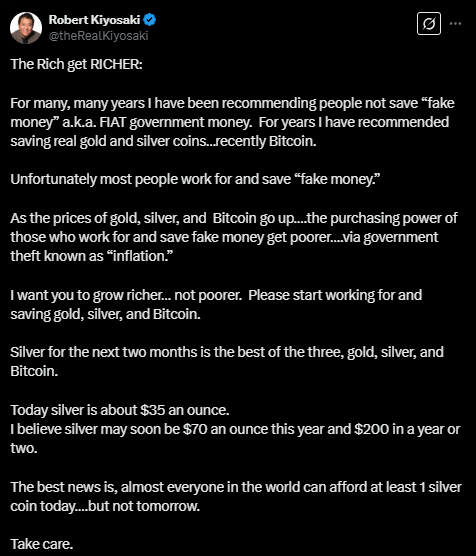

In a series of recent posts on X, Kiyosaki projected that silver could reach $70 per ounce soon, with a longer-term upside to $200, citing its affordability and the weakening value of fiat currency as primary drivers.

While Kiyosaki has been a vocal supporter of Bitcoin for years, his latest comments highlight a temporary pivot in strategy.

“Silver for the next two months is the best of the three: gold, silver, and Bitcoin,” he posted.

Kiyosaki believes silver remains undervalued and more accessible to everyday investors. With silver currently trading well below its historical highs, he views it as a practical entry point for those seeking protection against inflation and monetary instability.

Warning Against Fiat: “The Rich Get Richer”

Kiyosaki’s advocacy for real assets is rooted in his long-standing criticism of fiat currencies, which he refers to as “fake money.” In his recent commentary, he warned that saving in fiat is a surefire way to lose purchasing power as inflation eats away at the dollar’s value.

“I want you to grow richer… not poorer,” he said. “The best news is, almost everyone in the world can afford at least one silver coin today… but not tomorrow.”

He continues to encourage investors to accumulate gold, silver, and Bitcoin, believing these assets will serve as a hedge against what he calls “government theft” through inflation.

Kiyosaki also recently slammed crypto ETFs, claiming they mask the real value of the underlying assets. Unlike physically held gold, silver, or decentralized Bitcoin, he argues ETFs are financial constructs that expose investors to counterparty risks and centralized control.

His skepticism extends to the Federal Reserve and the traditional banking system, which he accuses of corruption and mismanagement. He reiterated his view that the U.S. dollar is “the biggest scam,” once again positioning Bitcoin as a long-term safeguard against institutional decay.

While silver is his preferred play in the immediate future, Kiyosaki hasn’t walked away from his bullish stance on Bitcoin. He recently suggested that a U.S. Bitcoin reserve could help stabilize the economy and restore financial confidence, hinting that BTC could be a game-changer for America’s fiscal health in the long run.

Final Thoughts

Kiyosaki’s latest endorsement of silver is less a rejection of Bitcoin or gold, and more a tactical shift based on timing and accessibility. As inflation concerns and economic uncertainty persist, he continues to advocate for real assets over fiat savings.

With silver offering a low-cost entry point and Bitcoin positioned for long-term transformation, Kiyosaki’s advice reflects a flexible yet principled approach to wealth preservation: own what’s real, avoid what’s fake.