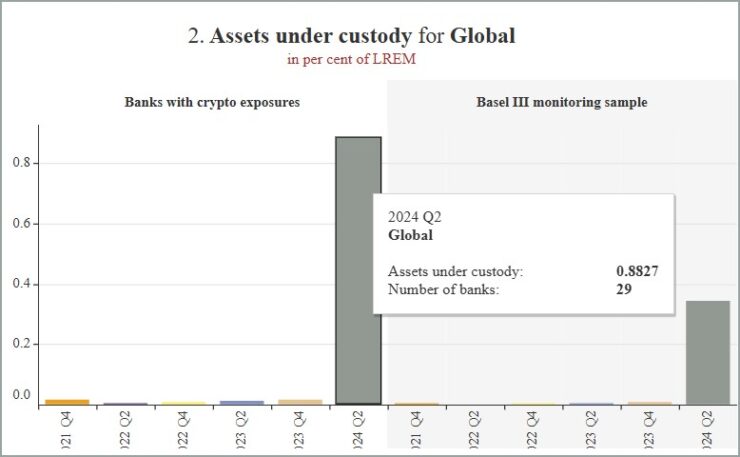

New data released by the Basel Committee on Banking Supervision (BCBS) dashboard highlights a sharp contraction in direct spot crypto holdings among the world’s largest banking institutions. As of Q2 2024, banks globally held approximately €341.5 billion ($368.3 billion) in crypto assets under custody, yet spot crypto now accounts for less than 3% of their total digital asset exposure; a significant drop compared to previous years.

The report, compiled from voluntary submissions by 176 international banks including 115 with cross-border operations, suggests that most institutions have pivoted away from holding Bitcoin, Ethereum, or other digital assets directly. Instead, they are turning to exchange-traded products (ETPs) and similar investment vehicles that offer crypto exposure without the operational and regulatory complexity of direct custody.

According to the BCBS, just 29 banks were responsible for the full €341.5 billion figure, and most of those allocations were concentrated in regulated investment products, not on-chain assets. The shift points to an increasingly cautious stance by banks, prioritizing compliance and capital protection over direct participation in volatile crypto markets.

This global realignment mirrors similar trends observed in U.S. banking data, reinforcing the notion that institutional crypto involvement is entering a new phase spurred by the proliferation of Exchange Traded Products in the world financial market.

Global Risk Guidelines Drive Institutional Pullback from Spot Crypto

The ongoing retreat from direct cryptocurrency holdings among global banks appears to be a calculated response to evolving regulatory expectations and risk management priorities. According to the Basel Committee on Banking Supervision (BCBS), which monitors the stability of the international banking system, banks have significantly reduced their exposure to spot crypto in line with guidance first issued in December 2022, which recommended that such holdings not exceed 2% of a bank’s total capital.

The recent survey shows banks are adhering closely to that threshold. Spot crypto holdings now account for just 2.46% of their overall crypto-related exposure, with the vast majority (92.5%) allocated to regulated investment products such as exchange-traded funds and notes that track crypto prices without requiring direct asset custody.

This strategic realignment follows a period of heightened scrutiny in the wake of high-profile banking failures in 2023, including Signature Bank and Silicon Valley Bank, both of which had deep ties to the crypto sector. Global financial watchdogs have since intensified oversight, aiming to ensure that institutional crypto involvement does not introduce systemic risk.

Rather than exiting the digital asset space entirely, banks appear to be navigating toward risk-mitigated, compliance-aligned instruments, effectively sidelining spot exposure in favor of products that offer regulatory clarity and operational simplicity. With capital requirements and accounting standards for crypto still under development, this cautious repositioning reflects a sector waiting for firmer ground before taking further steps into direct digital asset markets.

Regulated ETPs Gaining Traction as Preferred Exposure Route

One of the clearest beneficiaries of this shift has been the spot Bitcoin ETF market, which has seen billions in institutional inflows since the U.S. Securities and Exchange Commission approved a wave of new issuances in early 2024. Products like BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund have become primary vehicles for corporate and banking exposure to crypto.

Unlike direct holdings, these ETFs are exchange-traded, liquid, and custody-compliant, allowing banks to meet exposure goals without running afoul of regulatory requirements. The move also reflects the broader institutionalization of crypto where banks, asset managers, and corporations prefer to interact with digital assets through familiar investment channels rather than custodial wallets and private keys.

With ETF and ETP infrastructure expanding, banks are increasingly treating spot crypto like any other volatile commodity; something to gain exposure to, but not necessarily something to store on the balance sheet.

Quick Facts:

- Global banks held €341.5 billion ($368.3 billion) in crypto assets under custody as of Q2 2024, according to the Basel Committee on Banking Supervision.

- Spot crypto now represents less than 3% of banks’ total digital asset exposure, down sharply from previous years.

- Most banks have shifted toward regulated investment products like exchange-traded funds to manage crypto exposure.

- Only 29 of the 176 surveyed banks reported significant crypto holdings, with the majority avoiding direct on-chain asset custody.