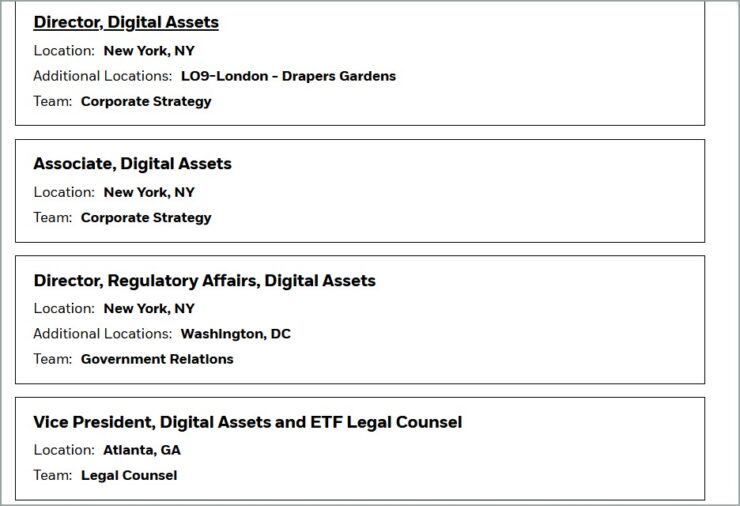

BlackRock has posted four new digital asset job listings, expanding its internal crypto bench at a time when Wall Street’s interest in blockchain-based finance is growing rapidly. The newly listed roles, which appeared this week on the firm’s careers portal, include Director of Digital Assets, Director of Regulatory Affairs, VP for Digital Asset and ETF Legal Counsel, and Associate for Digital Asset Strategy.

Three of the positions are based in New York, with one opening in Atlanta, and while the job descriptions are intentionally broad, they point toward a deeper operational shift at the world’s largest asset manager. The listings come as BlackRock continues to build momentum around its $1.7 billion BUIDL fund, which leads the market in tokenized securities; an area increasingly seen as the next frontier for institutional finance.

Unlike some of its peers who have hinted at possible ETFs for Solana, XRP, or Litecoin, BlackRock has kept quiet about future crypto product launches. But the firm’s methodical staffing of senior roles across legal, compliance, and digital strategy suggests something larger is in motion behind the scenes.

Since the return of President Donald Trump to the White House, several traditional financial institutions have stepped up their involvement in crypto markets. BlackRock, already a central player with its Bitcoin and Ethereum ETFs, appears to be solidifying its position not just as a passive issuer, but as an active architect of tokenized financial infrastructure.

BlackRock Maintains Strategic Focus on Tokenization as ETF Market Expands

BlackRock has maintained a cautious and measured approach to crypto product expansion, even as other asset managers push to launch exchange-traded funds (ETFs) for a broader set of digital assets. To date, the firm has introduced two spot crypto ETFs; the iShares Bitcoin Trust (IBIT) and the iShares Ethereum Trust (ETHE) both of which have attracted significant institutional participation.

However, BlackRock has not announced any intention to pursue similar products tied to altcoins such as Solana, XRP, or Litecoin, despite mounting industry interest.

These recent job postings suggest the firm is preparing for potential regulatory and product developments. Among the four new positions added to its digital asset division is a legal counsel role focused on ETF-related matters, indicating that BlackRock is seeking to deepen its expertise in digital asset fund structuring. The listings, while broad in description, align with the firm’s deliberate expansion into regulated crypto offerings.

While new ETFs remain a possibility, BlackRock’s primary focus appears to be centered on the tokenization of traditional financial instruments. The firm’s USD Institutional Digital Liquidity Fund (BUIDL), launched in 2023, has surpassed $1.7 billion in assets, making it the largest tokenized fund in the market to date.

The fund, which holds short-term U.S. Treasury assets, represents a key step in BlackRock’s broader effort to integrate blockchain technology into mainstream asset management.

BlackRock Ascent to Global Asset Management Leadership

Founded in 1988 by Larry Fink and seven partners, BlackRock began as a modest enterprise with a singular focus on risk management and fixed-income asset management. Over the decades, it has evolved into the world’s largest asset manager, boasting an impressive $11.6 trillion in assets under management as of the end of 2024.

Larry Fink, co-founder and CEO, has been the driving force behind BlackRock’s ascent. Under his stewardship, the firm has expanded its global footprint, offering a diverse range of investment and technology solutions. Fink’s strategic vision has positioned BlackRock at the forefront of financial innovation, continually adapting to the evolving needs of its clients.

Quick Facts:

- BlackRock has listed four new senior roles within its digital asset division, including positions in legal, regulatory, and strategy functions.

- The hires come amid growing institutional interest in tokenized finance and follow the firm’s successful launch of its $1.7 billion BUIDL fund.

- While competitors pursue ETFs for altcoins like Solana and XRP, BlackRock has remained silent on future crypto fund plans.

- The expansion signals BlackRock’s intent to build long-term digital asset infrastructure, beyond its existing Bitcoin and Ethereum products.