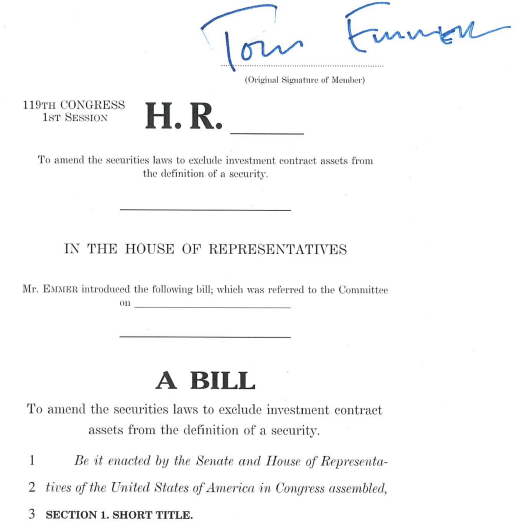

U.S. Representatives Tom Emmer (R-MN) and Darren Soto (D-FL) have reintroduced the Securities Clarity Act, a bipartisan effort designed to provide clear legal standards for the classification of digital assets. The move is being positioned as a foundational step toward broader crypto regulation, with the potential to shape the upcoming market structure legislation expected from Congress in the weeks ahead.

The Securities Clarity Act seeks to separate the concept of a digital asset from the securities contract it may initially be associated with. Under the bill, any asset sold as part of an investment contract would be defined as an “investment contract asset,” distinct from the securities offering itself.

This distinction could offer crucial protection for developers and entrepreneurs, who often find themselves operating in a regulatory gray zone.

“Entrepreneurs need clarity to calculate risk accurately, create new investment opportunities and grow our economy,”

Emmer said in a statement. “Our legislation will help provide these answers and allow American investors to fully participate in digital asset technology without sacrificing consumer protections.”

Building Toward FIT21 and Market Structure Legislation

Notably, the Securities Clarity Act has already been incorporated into the broader Financial Innovation and Technology for the 21st Century Act (FIT21)—a comprehensive digital asset framework that passed the House last year with bipartisan support, including backing from former Speaker Nancy Pelosi.

At The Digital Chamber’s DC Summit, House Financial Services Committee Chair French Hill (R-AR) stated that a revised draft of FIT21 may be released “in the next few weeks.” This signals that the Securities Clarity Act is not just standalone legislation, but a precursor to a more unified market framework that Congress is actively shaping.

Ron Hammond, senior director of government relations at the Blockchain Association, described the bill’s return as a potential “bipartisan precursor” to the full market structure package. He emphasized that the Securities Clarity Act is a key piece in defining how digital assets should be regulated in the U.S.

Hammond also noted a shift in the political landscape following recent bipartisan efforts, including congressional moves to repeal controversial tax rules impacting crypto investors. Senate Minority Leader Chuck Schumer was among the Democrats who voted in favor of that repeal suggesting broader support for a balanced, innovation-friendly crypto policy.

“Fair to say this continued momentum will be evident in the eventual crypto votes in Congress,” Hammond said.

What’s Next?

With the reintroduction of the Securities Clarity Act and updates to FIT21 on the horizon, lawmakers appear increasingly aligned on delivering a regulatory framework that fosters clarity without stifling innovation. If passed, the bill could protect non-custodial developers, streamline the token classification, and set a global standard for how digital assets are regulated.

As Washington inches closer to substantive crypto legislation, the Securities Clarity Act may be remembered as the catalyst that brought legal certainty to one of the industry’s most contentious questions: When is a token truly a security?