In a major victory for the crypto industry, Congress has voted to repeal the IRS’s DeFi broker rule, a controversial Biden-era regulation that sought to classify decentralized finance platforms as tax-reporting entities. With the Senate’s final vote on March 26, the resolution now heads to President Donald Trump, who is expected to sign it into law.

The decision could mark a turning point in U.S. crypto regulation, signaling a shift toward a more industry-friendly framework under the new administration.

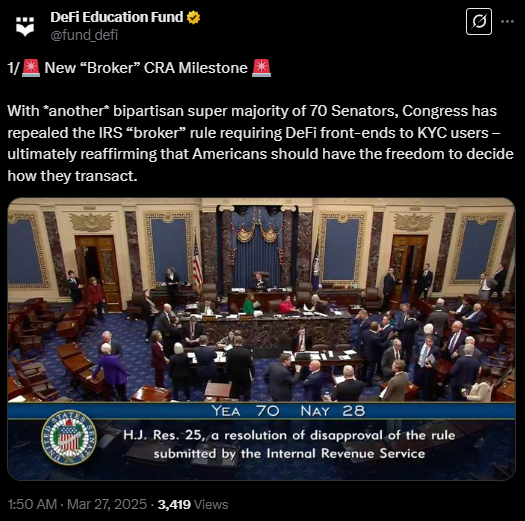

The Senate passed the repeal in a 70-28 bipartisan vote, following the House’s earlier approval on March 11. Though the Senate had previously advanced a version in early March, constitutional rules required a fresh vote after the House introduced its own budget-related version.

The measure cancels an IRS rule that would have required DeFi platforms like decentralized exchanges and automated protocols to report user transaction data and gross proceeds to the federal agency.

The rule was framed as part of the government’s effort to improve tax transparency in crypto markets, but opponents say it risked lumping innovative protocols with unworkable compliance burdens.

Industry Pushback – “Unworkable in Practice”

Crypto advocates have pushed back strongly against the rule, arguing that decentralized protocols don’t have the structure or user data access needed to comply with IRS reporting.

“This rule never made any sense and was unworkable in practice,” said Eli Cohen, general counsel at RWA tokenization platform Centrifuge, earlier this month.

Kristin Smith, CEO of the Blockchain Association, praised the Senate vote, calling it a step toward protecting innovation.

“We look forward to taking this harmful rule off the books for good,” she said in a statement.

According to David Sacks, the White House’s AI and crypto czar, President Trump supports repealing the rule, further reinforcing the new administration’s pro-crypto stance.

Trump’s signature would officially bury the IRS directive and send a broader message: that U.S. crypto regulation may begin to favor innovation over enforcement, at least under the current leadership.

Not everyone welcomed the repeal. Democratic Representative Lloyd Doggett criticized the vote, framing it as a “special interest exemption” that benefits wealthy crypto holders.

“This loophole will be exploited by tax cheats, drug traffickers, and terrorist financiers,” Doggett warned, adding that the rule’s repeal would make tax evasion far easier via decentralized exchanges.

But for most in the crypto space, the vote represents a course correction, an acknowledgment that decentralized networks can’t be regulated the same way as traditional financial intermediaries.

What’s Next

The repeal of the IRS DeFi broker rule may set the tone for a new era of crypto regulation in the United States—one that recognizes the structural differences of decentralized platforms and prioritizes workable compliance over sweeping enforcement.

With Trump expected to sign the resolution into law, the crypto industry could see a friendlier regulatory environment, potentially attracting more innovation and capital to U.S. shores.

As DeFi continues to evolve, the message from Washington is clear: regulation must evolve with it or risk stifling the next wave of financial innovation.