Curve Finance founder Michael Egorov is once again at the center of market controversy after offloading over 2 million CRV tokens this week, raising fresh concerns about the project’s tokenomics and potential price pressure.

The sell-off comes despite an ongoing rally, leaving investors wondering if Curve’s price gains are sustainable or if deeper cracks are forming beneath the surface.

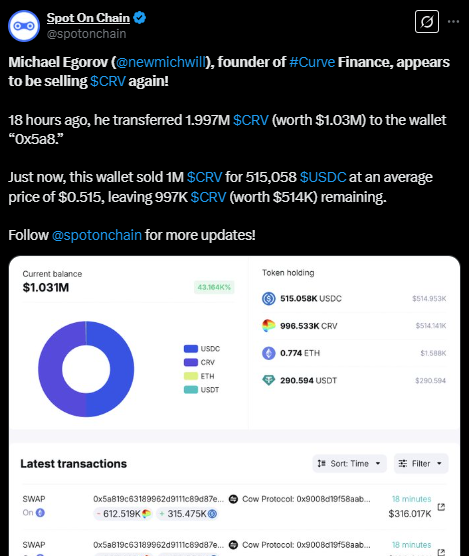

According to data from Spotonchain on X, Egorov transferred nearly 1.997 million CRV tokens, worth around $1.03 million, to wallet “0x5a8”. Blockchain data reveals that 1 million of those tokens were quickly liquidated for 515,058 USDC at an average price of $0.515. The wallet still holds 997,000 CRV, signaling more potential sales ahead.

Earlier in the week, Egorov sold 468,769 CRV tokens for 238,171 USDC, averaging $0.508 per token, according to SpotOnChain data.

In total, the Curve founder has offloaded around 2.5 million CRV tokens in just a few days—fueling community speculation about his motives and the possible impact on CRV’s price.

Why is Egorov Selling Now?

Interestingly, Egorov purchased most of these tokens in December 2023 at an average price of $1.114 per token. With CRV currently trading near $0.55, he’s now sitting on a loss of nearly 55% on those buys.

The timing of these sales—right amid a 12% daily and 23% weekly price rally—has triggered theories that Egorov is simply cutting losses while market momentum allows.

Still, many in the community fear these large, strategic dumps signal underlying concerns about the project’s future or the founder’s waning confidence.

Despite the sell pressure, CRV defied expectations, rallying 12% intraday to $0.5560 after hitting a low of $0.4927. However, market watchers warn that such rallies can quickly reverse if large sell-offs continue.

Analyst CrediBULL Crypto remains bullish, pointing to the CRV/XRP pair’s breakout potential. Still, they acknowledge that uncertainty lingers, especially as CRV’s future price action now hinges on both technical factors and founder behavior.

What’s Next for CRV?

With Egorov’s wallet still holding nearly 1 million CRV, the market remains on edge. Investors are now watching closely for signs of additional dumps, which could amplify price volatility and shake confidence further.

Curve’s recent surge shows resilience, but the founder’s sell-off spree leaves a critical question hanging: Can CRV maintain upward momentum if its own creator keeps cashing out? For now, the waters remain murky and CRV’s next move could set the tone for its near-term future.